Will Shadow Banking Bankrupt Your Bank?

Latest article on bank safety by Avi Gilburt and Renaissance Research: Will Shadow Banking Bankrupt Your Bank?

We have written a lot about shadow lenders and their connections to traditional banks over the past year.

Lately, there were also several statements from global banking regulators discussing shadow banking. Klass Knot, the head of the Financial Stability Board (FSB), which is the world’s financial stability watchdog, issued a statement about the regulator’s key areas of concern. Notably, this statement was almost fully focused on vulnerabilities in shadow lenders.

In addition to the FSB’s statement, there was also an interview with Elizabeth McCaul, a member of the European Central Bank’s supervisory board, who said that the “remarkable” growth of non-banks was the biggest threat to the stability of the Eurozone’s financial system.

Furthermore, Michael Hsu, the CEO of the Office of the Comptroller of the Currency, which is one of the largest regulators in the U.S., told the Financial Times when asked about shadow banking lenders that “he thought the lightly regulated lenders were pushing banks into lower-quality and higher-risk loans.”

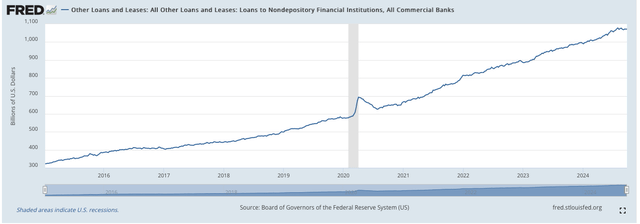

According to the Fed, loans to shadow lenders granted by U.S. banks were $1.1T as of the end of September.

St. Louis Fed

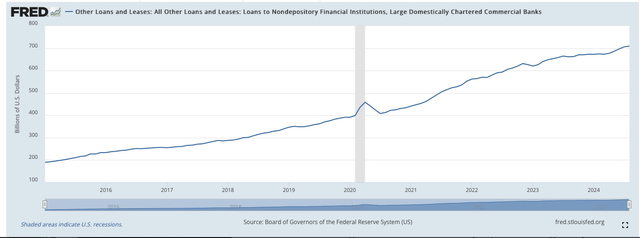

Shadow lending is an issue mostly for larger banks, and the Fed data confirms this. More than 65% of these loans to shadow banking intermediaries were granted by the 25 U.S. largest banks.

St. Louis Fed

However, the rest, 35%, or almost $400B, were granted by smaller banks. As such, shadow lending is becoming an issue for them as well.

Several weeks ago, there was an article about First & Peoples Bank, a community lender located in Kentucky. In August 2020, the bank signed a partnership with a fintech, US Credit. According to the article, First & Peoples was lending money to US Credit, which did all the servicing of the loans, setting them up and collecting payments, and most importantly, deciding to whom to lend. In other words, US Credit did not bear any credit risk. As a result, the fintech was granting extremely risky loans, which became later non-performing and led to huge losses for First & Peoples Bank.

According to the FFIEC, as of the end of September, 23.4% of First & Peoples Bank’s credit portfolio, or more than $25MM, were non-performing. By comparison, the bank’s equity was $16MM, implying First & Peoples Bank is underwater and is on the brink of a collapse.

In this article, we would like to discuss potential reasons why a community bank with a focus on traditional banking started this partnership. We would also like to show that proper due diligence with a focus on forward-looking indicators had been indicating that this was a bank to avoid from a retail depositor perspective for several years.

Of course, we do not know the exact reasons why First & Peoples’ management signed an agreement with US Credit. But a deep dive into the bank’s financial statements is giving us some hints.

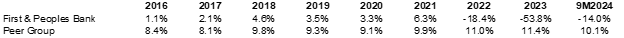

First, the bank’s ROE has been lagging that of its peers for many years. This indicator is calculated as a bank’s net profit divided by its average equity. Without a doubt, this ratio is the most popular key performance indicator as it measures a bank’s profitability, or, in other words, how efficiently a bank’s capital is being used. It also measures a bank’s organic capital generation, which is very important in a volatile environment. We believe that First & Peoples’ management wanted to improve the bank’s ROE using this partnership with US Credit.

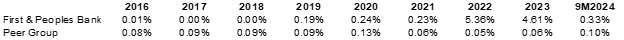

Here is the table that shows the dynamics of a return on equity for First & Peoples and its peer group.

Return on Equity, %

FFIEC

During 2016-2020, the gap between First & Peoples’ ROE and that of its peer group was quite large. So, in August 2020, the bank signed an agreement with US Credit. Obviously, any bank that enters a high-risk lending segment will see a short-term increase in its profitability level as higher-risk credit products have higher yields. As we can see, this is the case for First & Peoples. And, in 2021, the gap between its ROE and that of the peer group shrank. Yet, unsurprisingly, this effect was short-lived, as the bank was hit by asset quality issues and has been losing money since 2022.

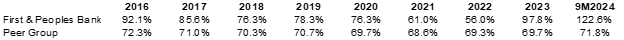

One of the key reasons why First & Peoples has such a weak ROE is the bank’s efficiency ratio. This is also a popular key performance indicator for banks. The metric is calculated by dividing a bank’s total non-interest expenses by its total operating income. The indicator is very important for any bank and measures its operating efficiency. To put it simply, the lower the efficiency ratio is, the better a bank is at managing and controlling its noninterest expenses.

Here is the table that shows the dynamics of an efficiency ratio for First & Peoples and its peer group.

Efficiency Ratio, %

FFIEC

Similar to the ROE dynamics, during 2016-2020, the gap between First & Peoples was relatively significant. Then, in 2021, the gap shrank, as the bank laid off employees who were responsible for credit risk management, given the partnership with US Credit. This is also the reason why First & Peoples’ ROE improved in 2021. This improvement in the bank’s CIR was also short-lived.

We are also looking at First & Peoples’ cost of risk and that of its peer group. For starters, this indicator is calculated by dividing a bank’s total loan loss provisioning charges by its total assets or total loans. Together with ROE, NIM, and efficiency ratio, COR is among the key performance indicators. It measures how risky a bank’s lending business is. Banks with a lower COR have better asset quality and more prudent credit risk management.

Cost of Risk, %

FFIEC

During 2016-2019, First & Peoples had a low cost of risk, which is typical for a community bank with a focus on 1-4 family residential mortgages. Just several months after the partnership with US Credit, the bank saw a higher COR. In our view, First & Peoples should have stopped working with US Credit in early 2022, when the bank’s cost of risk started to rise. This should have also been a wake-up call for retail depositors.

But, the bank continued to work with US Credit, and that eventually led to a 23.4% default ratio, or $25MM of defaulted loans, which is more than its equity of $16MM. Of course, we do not know the terms of the agreement, and there is a possibility that First & Peoples could not terminate the partnership instantly. But in this case, it was clearly a huge mistake to sign such an agreement.

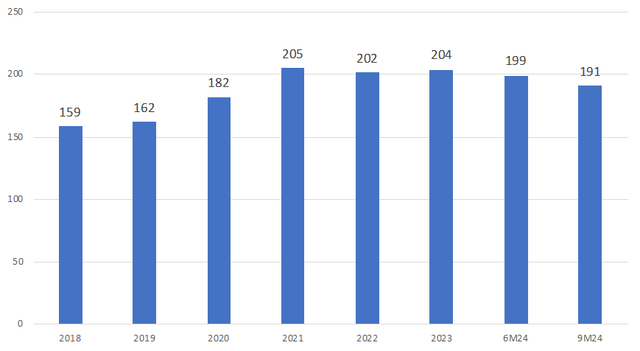

Finally, it is important to note that despite the bank’s ugly financial performance that it has been demonstrating since 2022, First & Peoples’ deposits have been relatively stable. In fact, the deposit dynamics of the bank over the period of 2022-2044 has been better than that of many of the largest U.S. banks. Actually, the largest outflow occurred in Q324, probably after media reports about First & Peoples.

First & Peoples: Total deposits, $MM

FFIEC

Some might say that depositors are just relying on the FDIC protection, which is why they did not flee the bank as the performance tanked. Over the last two years, we have written a lot about issues with the FDIC protection.

What is also a head scratcher is that, as of the end of September, First & Peoples still had 65 accounts with more than $250K each, which totaled $33MM. The only explanation we have is that depositors are simply unaware of the bank’s major issues. At the end of the day, very few look at the financial statements of their bank and do a proper financial analysis.

Bottom Line

If you follow our banking work, you know that we have been writing mostly on larger banks. And, while there was one major issue which caused the GFC back in 2008, today we currently have many more large issues on these bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what caused the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. First & People is one such example. You do not want to be suddenly surprised that your bank is underwater when you read the morning news. That’s why it's absolutely imperative to engage in thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks, including those noted above, in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that more recent issues surrounding banks like New York Community Bancorp (NYCB) are reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. Review our due diligence methodology here.