We Are Seeing The Initial Cracks In Bank Stability - Time To Be Cautious

The FDIC recently released its Quarterly Banking Profile, a publication that summarizes the financial performance of all FDIC-insured institutions.

In this article, we would like to highlight the key takeaways from the publication, which, in our view, suggest that most U.S. banks are very likely to face major liquidity issues soon.

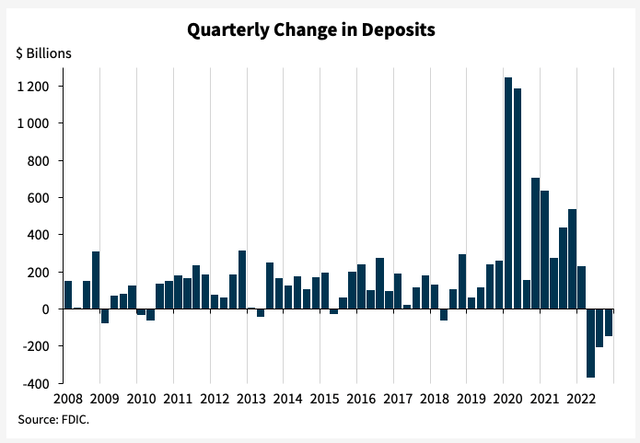

The system has lost more than $700 billion in deposits since 1Q22

The sector’s total deposits declined by 4% since the first quarter of 2022 to $19,215B as of the end of 2022. As a result, after three consecutive quarters of outflows, the U.S. banking sector has lost more than $700 in deposits. These numbers suggest that clients, who are the most rate sensitive, have already started to move their money elsewhere.

FDIC

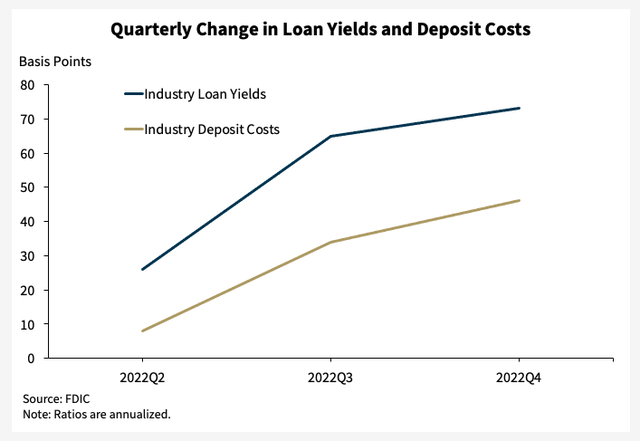

Importantly, the average industry deposit cost is still quite low, as it was just 99 bps for the fourth quarter of 2022. Although, as the chart shows, it grew by 46 bps QoQ, implying that it almost doubled compared to 3Q22.

FDIC

It goes without saying that the average industry deposit cost will increase again this year because it lags changes in the Fed's policy rate. As a result, either the U.S banks would have to raise their deposit rates or see a sharper decline in deposits. While the latter would almost certainly result in liquidity problems as the banks need to fund loan growth, the former would put pressure on their net interest margins and, eventually, earnings.

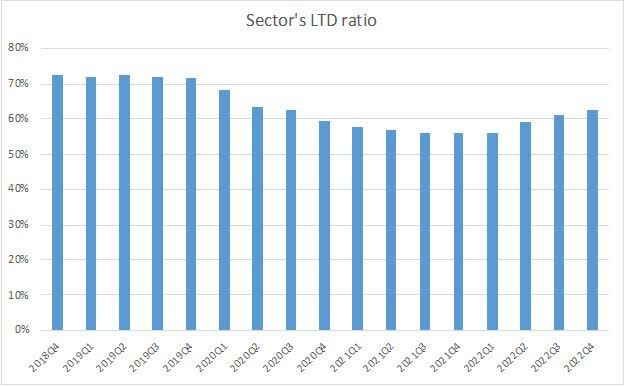

Even though the sector's loan-to-deposit ratio was a solid 63% at the end of 2022, the metric has gone up 7 percentage points since 1Q22.

FDIC

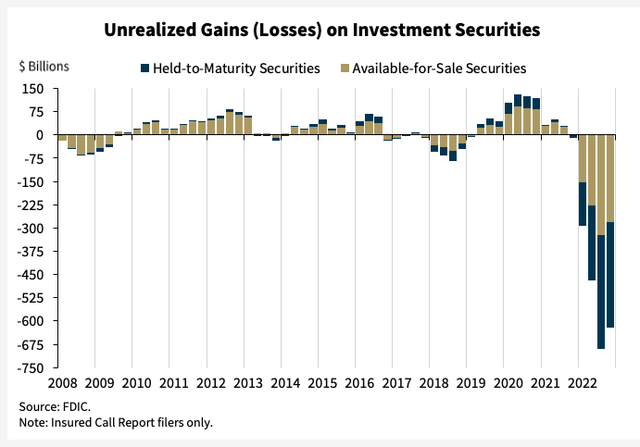

In theory, if a bank faces a deposit outflow, it can sell some of its liquid assets, including securities. But the problem here is that even in this relatively benign environment, securities can be sold only at a huge loss. The chart below shows that unrealized losses on AFS (available-for-sale) and HTM (held-to-maturity) securities totaled $620B in 4Q22.

FDIC

In our previous articles, we highlighted that most large U.S. banks have longer-duration securities books, which are very sensitive to changes in market yields. Here's a quote from our recent article:

"This is another major issue that is not being tested by the Fed. Many U.S. banks have a large maturity mismatch between their assets and liabilities. For example, in our recent article on Capital One (COF), we showed that 84% of the bank’s securities have maturities longer than 10 years. Capital One does not disclose the average maturity of its deposit book, which is a major part of its liabilities; however, it's highly likely that it is much less than 10 years, especially given that Capital One currently does not offer deposits with a term of more than five years. Such a maturity mismatch between the bank’s assets and liabilities would likely lead to major liquidity issues in a volatile environment and be a significant risk for depositors."

The SVB case

The most important thing is that the issues we are discussing have already materialized at Silicon Valley Bank, which is a Top-20 U.S. bank. The bank faced quite significant deposit outflows in 3Q22 and 4Q22, which led to liquidity issues. SVB attracted $15B in emergency short-term funding from the San Francisco Federal Home Loan Bank. But that was not enough, and the bank had to sell $21B of its available-for-sale securities, resulting in a loss of $1.8B. Finally, SVB announced an emergency capital raising of $2.25B. As a result, the shares of its parent company, SVB Financial Group (SIVB) fell by 40% in early Thursday trading.

We will cover the SVB case in more detail in our next article as we believe such cases could directly affect depositors in a systemic crisis scenario.

The bottom line

In contrast to SIVB and most other large U.S. banks, the Top-15 U.S banks we have found at Saferbankingresearch.com are still enjoying deposit inflows and have below-peer deposit costs due to their low-risk business models. The share of securities on their balance sheets is lower than that of peers, and their securities book is shorter-duration, implying they are less sensitive to changes in market yields.

As an investor, it behooves you to perform appropriate due diligence upon the banks which you choose to house your hard earned money. And, when you do, you may be quite surprised, and even scared.

If you would like to review the methodology that we utilized to analyze a bank when you perform your own review, feel free to read it here.