Warning: Nearly 2,000 US Banks Are At Risk Of Failure Between 2026 And 2027

Please see our latest article on bank safety.

Warning: Nearly 2,000 US Banks Are At Risk Of Failure Between 2026 And 2027

This week, Florida Atlantic University published an update on its U.S. Banks’ Exposure to Risk from Commercial Real Estate screener. The update revealed a significant deterioration in the balance sheets of banks exposed to CRE (commercial real estate lending).

According to the report, among banks of all sizes (approximately 5000 in the US):

- 1,788 banks have total CRE exposures greater than 300% of their total equity capital, up from 1,697 in Q3;

- 1,077 have exposures greater than 400%, up from 971 in Q3;

- 504 have exposures greater than 500%, up from 426 in Q3;

- 216 have exposures greater than 600%, up from 166 in Q3.

As these results show, there was an increase in the number of problematic banks across every category. In fact, when we consider that there are approximately 5000 banks in the United States, over one third have serious exposure to CRE issues. Notably, among the 158 largest U.S. banks, 59 are facing exposures greater than 300%.

Many analysts from investment banks and Fed officials have argued that CRE lending is primarily an issue for smaller regional banks. However, if you follow our banking work, you know that for over two years, we have consistently warned that CRE lending would impact the majority of the banking sector, including the largest banks.

Among the 10 largest U.S. banks, seven have total CRE exposures greater than 50% of their total equity capital. These include:

- JPMorgan (56%)

- Wells Fargo (80%)

- U.S. Bank (77%)

- PNC (88%)

- Truist (89%)

- Capital One (51%)

- TD Bank (74%)

Even if these banks were not facing other major issues on their balance sheets, CRE exposure alone could lead to significant problems. Yet, the Fed recently announced easier and less conservative assumptions for CRE in its 2025 stress tests, a topic we discussed in our previous article.

In addition, many banks with total assets between $50B and $100B have exposure ranging from 350% to 500%. Probably one of the most notable names is Flagstar Bank, the rebranded name of NYCB. Flagstar Bank, with a balance sheet of more than $100B, has CRE exposure greater than 541%.

Other large banks with significant CRE exposure include:

- Zions (415%)

- Valley National Bank (395%)

- Synovus Bank (410%)

- Umpqua Bank (372%)

- Old National Bank (303%)

Last year, we cited an academic paper from USC, Columbia, Stanford, and Northwestern on commercial real estate lending in the U.S. Importantly, this is an independent analytical study, and unlike investment banks and rating agencies, academic researchers generally do not have conflicts of interest.

According to the paper, due to higher interest rates and the widespread adoption of remote work, 14% of all CRE loans and 44% of office-related loans appear to be in "negative equity." This means the current value of the properties serving as collateral for these loans is less than the outstanding loan balances. Furthermore, the paper estimates that around one-third of all CRE loans and the majority of office-related loans may face significant cash flow problems and refinancing challenges. In other words, 33% of all CRE loans are likely to become problematic or non-performing.

If we assume a 33% non-performing loan (NPL) ratio for CRE loans, even banks with CRE exposures greater than 100% of their total equity will face major issues, as 33% of their capital could be wiped out. Needless to say, banks with CRE exposures greater than 300% are at a very high risk of failure—and there are nearly 2,000 banks in this category. Yes, you read that right. There are nearly 2,000 banks that are at risk of failure on this issue alone.

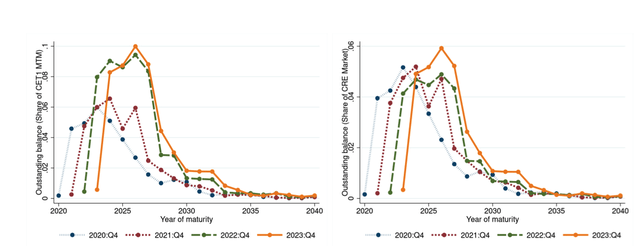

Finally, it is crucial to note that the CRE crisis has not yet fully materialized. In previous articles, we have repeatedly highlighted that the U.S. banks have adopted a strategy of "extend and pretend." As the New York Fed explicitly stated, "U.S. banks are extending their impaired CRE mortgages to avoid writing off their capital, leading to credit misallocation and a buildup of financial fragility." As a result, banks will face a "maturity wall," representing a major risk to financial stability. This maturity wall is expected to peak between late 2025 and 2027.

NY Fed

Source: NY Fed

As we have emphasized, the worst of the CRE issues are yet to come.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Review our due diligence methodology here.