Very Troubling Results For The Banking Industry Presented By Citibank And JPMorgan

We have written quite extensively over the last several years about major issues in the credit card segment of the banking industry. The recent sector data has indicated that these issues now look even more worrisome.

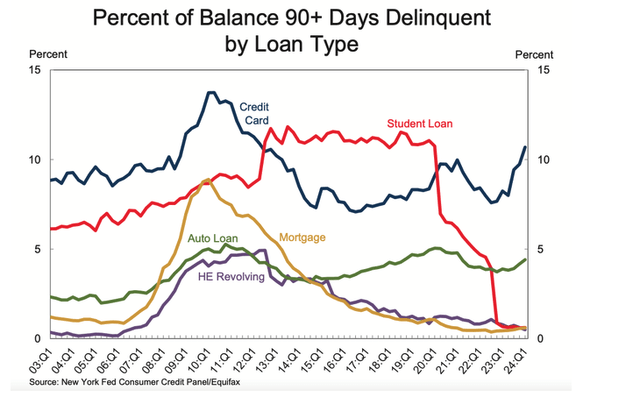

As of the end of 1Q24, the 90+ day delinquency ratio on credit cards was already above 10%. According to the Household Debt Report published by the NY Fed, in the first quarter 8.9% of credit card balances transitioned into delinquency, and 6.9% of credit card balances transitioned into serious delinquency

NY Fed

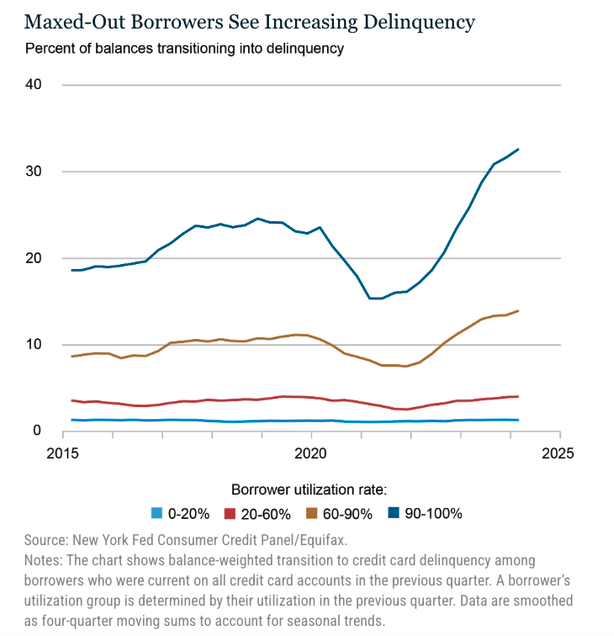

Most importantly, there was a huge increase in the delinquency ratio among low-income borrowers, which looks especially concerning given the reasons that led to the Great Recession. As the chart below shows, there was a huge increase in the transition ratio among borrowers with a 90-100% utilization rate and also quite a remarkable increase among borrowers with a 60-90% utilization rate. As a reminder, a high credit card utilization rate is usually a sign that a borrower has a tight cash flow situation and likely has a lower income.

NY Fed

Given all these issues, it was very interesting for us to look at 2Q24 numbers, which have been recently published by JPMorgan (JPM) and Citi (C), the two-largest credit card lenders in the country. What we have learned from the results is that the situation in this credit segment has become even more serious.

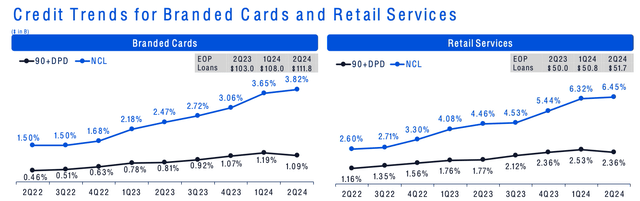

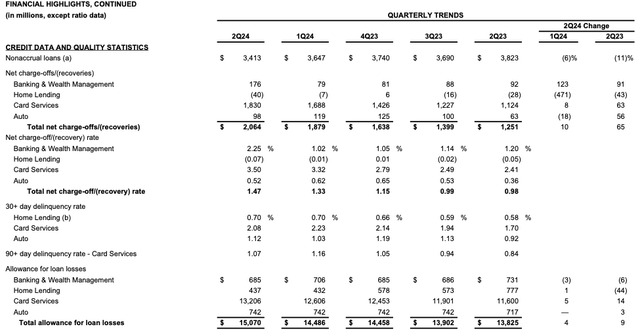

Here is the chart that shows the dynamics of delinquency ratios and net charge-off rates for Citi’s credit card business.

Company Data

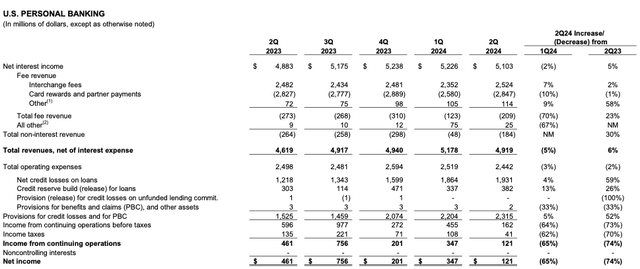

We have written a lot about why credit quality metrics will likely deteriorate further. However, even with the current metrics that are not that high, loan loss provisions in the second quarter corresponded to almost half of the Citi U.S. Personal Banking segment’s revenue. As the table below shows, in 2Q24, net revenue was $4.9B, while loan loss provisions were $2.3B. As a result, due to a combination of sluggish revenue and growing provisions, Citi’s net income in the U.S. personal banking segment fell by 74% YoY and 65% QoQ in 2Q24. In other words, even a mild further deterioration in the asset quality metrics of Citi’s credit card business would likely make this segment loss-making.

Company Data

It is also worth noting that Citi’s CFO mentioned issues with low-income borrowers in the credit card segment on the results call:

But as I think about what we're seeing now, there is that dichotomy that I mentioned where we have the higher FICO score customers that are driving the spend growth and that frankly have still continued strong balances and savings and it's really the lower FICO band customers, where we're seeing the sharper drop in payment rates and more borrowing.

The rhetoric of this statement suggests that this is a very minor issue; however, as we know, the management of large banks is almost always very optimistic on these calls. Recall the recent NYCB (NYCB) case. The bank’s management had been saying that its CRE portfolio was in excellent condition for many quarters, then suddenly the bank posted huge losses from this segment, and it would have likely failed without additional financing from a third-party entity.

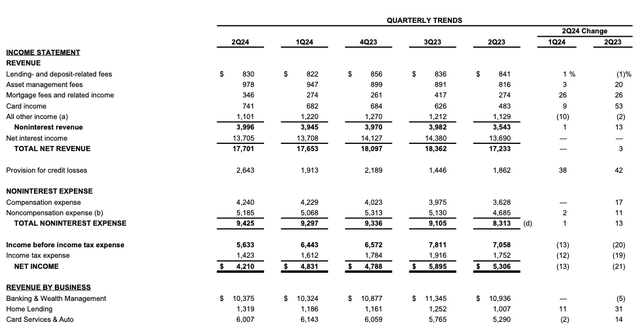

Here are the numbers from JPM. Total gross revenue for Cards Services and Auto was $6.0B in 2Q24.

Company Data

Loan loss provisions for Card Services were $1.8B in 2Q24, up 63 YoY. JPM does not disclose net revenue for its Card Services segment; it is fair to assume that card-related provisions likely also account for almost half of the segment’s net revenues, similar to Citi’s ratio.

Company Data

JPM’s CFO also made some comments regarding low-income borrowers:

As I say, we always look quite closely inside the cohort, inside the income cohorts. And when you look in there, specifically, for example, on spend patterns, you can see a little bit of evidence of behavior that's consistent with a little bit of weakness in the lower income segments where you see a little bit of rotation on the spend out of discretionary into non-discretionary.

Similar to Citi CFO’s rhetoric, this comment does not suggest that this is a major issue; however, we have already expressed our views regarding all these statements from large banks on their results call.

Bottom line

Credit quality dynamics in the card segment are not the only issue for larger banks. As we have said several times, whereas the 2007–2009 financial crisis had one main issue that caused the banking meltdown at the time, we're currently heading into an environment with multiple issues sitting on many bank balance sheets. And, this issue is certainly getting worse for bank balance sheets.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bancorp (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. You are welcome to use our due diligence methodology outlined here.