US Banks Have Huge Exposure To Asian Commercial Real Estate Issues

Latest article on bank safety by Avi Gilburt and Renaissance Research

US Banks Have Huge Exposure To Asian Commercial Real Estate Issues

A couple of weeks ago, Financial Times highlighted that HSBC’s (HSBC) exposure to defaulted commercial property loans in Hong Kong surged almost sixfold in the first half of this year. HSBC is a Top-10 global bank, and its assets are more than those of Citigroup (C) or Wells Fargo (WFC).

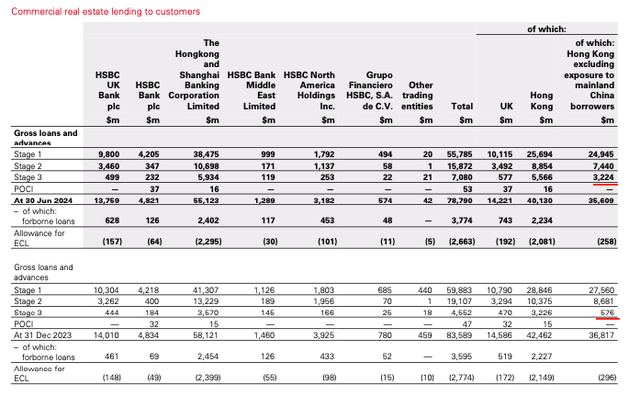

As the table below shows, defaulted or Stage 3 CRE-related loans grew from $576 MM as of YE23 to $3,224 MM as of 1H24. Importantly, those are loans, which were granted in Hong Kong, excluding any exposure to mainland China.

Company Data

As a result, more than 9% of the bank’s CRE loans in Hong Kong are now defaulted.

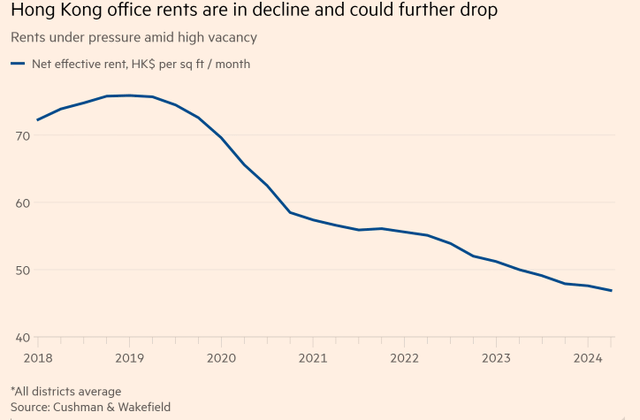

Many of you have probably heard about a huge crisis in the Chinese property development market. It was started by the bankruptcy of Evergrande, which was one of the largest developers in China. Following the default of Evergrande, a lot of large property developers, such as Country Garden, Zhongzhi, Zhongrong and many others, faced major issues. Before the beginning of the year, the majority of developers’ defaults had occurred largely in mainland China. However, HSBC’s numbers showed that Hong Kong is also facing issues in the property sector. Given the dynamics of office rents in Hong Kong, the property crisis there has only started.

Financial Times

But why do we think this news is so important for the U.S. banks?

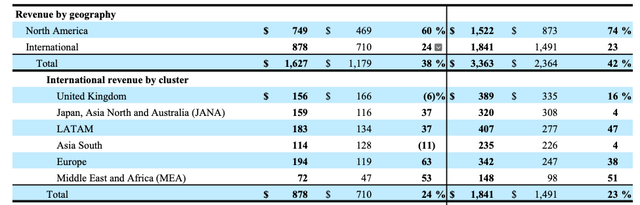

Over the past couple of decades, some large U.S. banks have been increasing their international exposure, with a particular focus on Asia and Latin America. Citigroup is the most notable example here. If we look at the bank’s latest 10-Q, we’ll see that revenue from non-U.S. business is already higher compared to that from North America.

Company Data

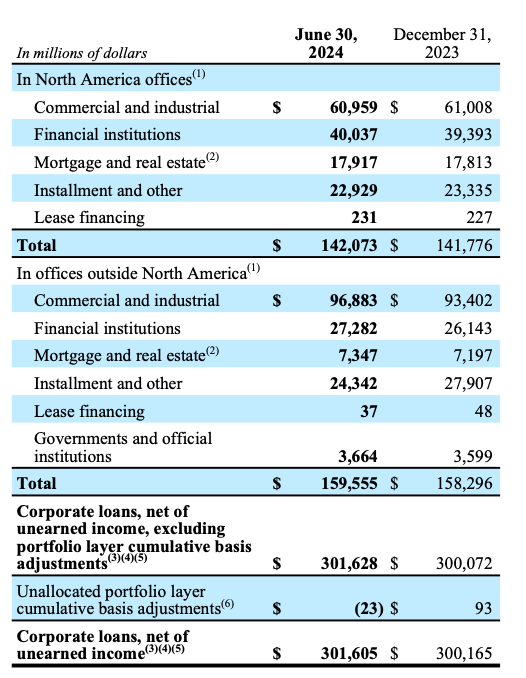

The table below shows a breakdown of Citi’s corporate loan portfolio. It is worth noting that a lot of loans to property developers are often classified as “commercial and industrial” rather than “mortgage and real estate".

Company Data

As you can see, international corporate loans account for 53% of Citi’s total corporate portfolio, and commercial and industrial loans account for more than 60% of the bank’s total international corporate lending.

We are yet to see how this property crisis will affect Citi, but the bank is the most exposed one among larger U.S. banks. Of course, non-U.S. business had been very profitable for Citi during a booming economy, but now it is a major risk, as we are likely going to transition into a bear market in the coming years.

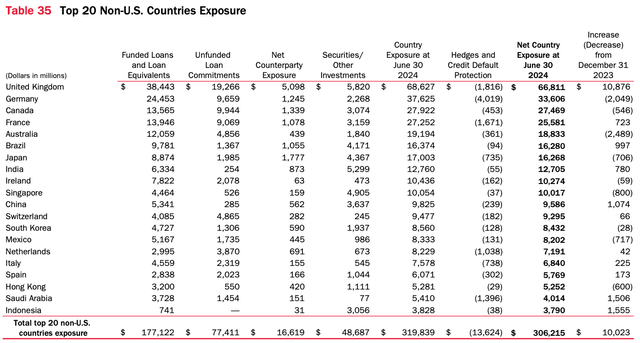

Notably, there are also other large U.S. banks which have significant exposure to non-U.S. jurisdictions. Below is a table from Bank of America’s (BAC) latest 10-Q.

Company Data

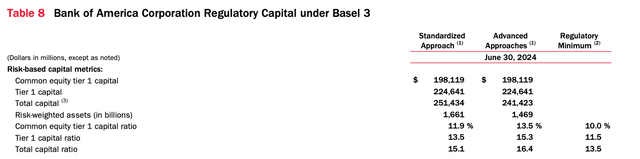

As you can, BAC’s net exposure to top-20 non-U.S. countries is $306B. It may come as a surprise for some, but this is more than the bank’s equity.

Company Data

Bottom line

Believe it or not, there are more major issues on larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking lending has exploded. So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks, including those noted above, in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that more recent issues surrounding New York Community Bancorp (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. Review our due diligence methodology here.