The NY Fed Is Sounding The Alarm About Commercial Real Estate

Latest article on bank safety by Avi Gilburt and Renaissance Research: The NY Fed Is Sounding The Alarm About Commercial Real Estate

Following the Q3 earnings season, there have been quite a lot of comments from the banks’ management and analysts about the commercial real Estate (“CRE”) space. Interestingly, many of them said that the U.S. CRE sector is in much better shape than some had feared. One of their arguments is that the majority of U.S. lenders posted moderate increases in CRE-related defaulted loans, while the level of CRE non-performing loans is still very low by historical standards.

If you follow our banking work, you know that we have been writing a lot about the U.S. CRE sector. In particular, we have said many times that it is incorrect to measure the health of the CRE lending by looking at the share of non-performing loans. And the reason is very simple. The majority of U.S. banks are not able to recognize bad CRE loans due to their weak balance sheets. Here is what we noted in our article on Aareal Bank.

In our view, given that Aareal Bank has relatively little exposure to U.S. office loans, it had the opportunity to be more conservative and recognize bad loans at one time. Obviously, if any large U.S. bank reports a 25% NPL ratio on its office portfolio, that would very likely trigger a major shock in the banking system. That suggests to us that U.S. banks will recognize bad loans in the CRE space very gradually. However, despite that, they will still incur all the losses from this lending segment.

To recap, in March, Aareal Bank, a German banking group, reported that 25% of its U.S. office loans had defaulted in the last quarter of 2023.

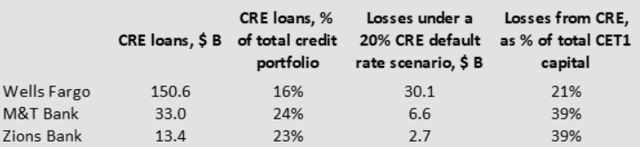

In our article on Aareal Bank, we also did a short stress test for three U.S. banks, showing that their weak capital position is the reason why they can recognize bad CRE loans like Aareal Bank and several other foreign institutions. We applied a 20% default ratio in the CRE space for Wells Fargo (WFC) and also to several super-regionals, which have relatively high exposure to CRE loans, such as M&T Bank (MTB) and Zions Banks (ZION). Here are the results.

Seeking Alpha

We think you can easily draw your own conclusions from the table above. The share of non-performing CRE loans remains low due to the fact that the majority of banks have weak capital positions and not because “the situation is improving,” as some have said.

The NY Fed has recently published a research study in which it confirmed our thoughts on the CRE space. The paper said that banks "extended and pretended” their impaired CRE mortgages in the post-pandemic period to avoid writing off their capital, leading to credit misallocation and a buildup of financial fragility.

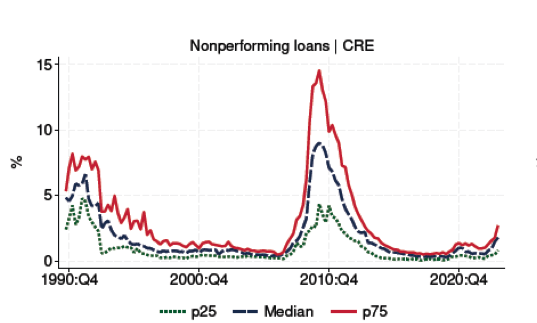

The NY Fed said that the level of bad CRE loans is indeed low by historical standards.

NY Fed

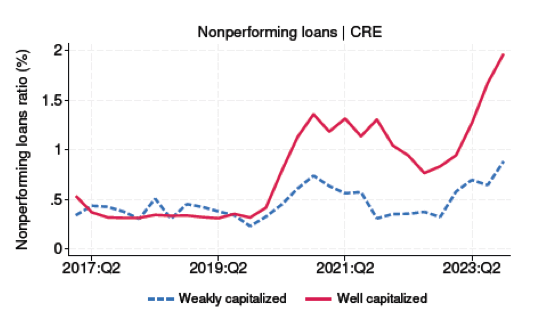

However, it also shows that the sluggishness in recognizing non-performing loans was driven largely by weakly capitalized banks.

NY Fed

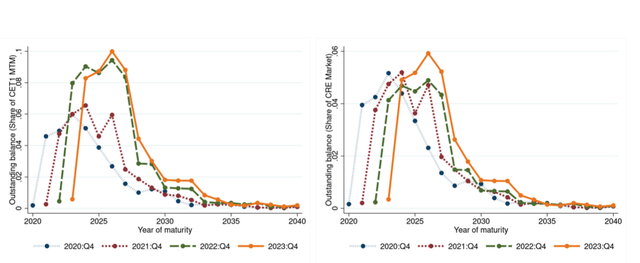

Moreover, the regulator also noted that by the end of 2023, office valuations are around 40% lower than their Q4 2021 level. Based on all the data, the NY Fed says that this sluggishness in recognizing bad loans, which is often called the extend-and-pretend behavior, has also led to an ever-expanding “maturity wall", namely an increasing volume of CRE loans set to mature in the near term, which represents a major financial stability risk. The study says that the size of this maturity wall is substantial when compared to the stock of bank capital. As of Q4 2020, loans maturing within three years only represented 16% of capital. By Q4 2023, this figure rose to 27%. Using a five-year horizon, the maturity wall expanded from 24% to 40% of capital.

NY Fed

Finally, the regulator makes the following conclusion.

The expansion of the maturity wall represents a financial stability risk as a sizable, and increasing, portion of bank regulatory capital is at risk should these CRE loans default. The possibility of a large and sudden capital hit for banks becomes more likely as the maturity wall becomes taller. This hit to capital has two risks. First, it might trigger a run by depositors (or by liquidity providers more in general), due to solvency concerns, especially if banks sit on large existing marked-to-market losses in their holdings of securities. Second, it might trigger a wave of foreclosures or sales of CRE loans in secondary markets, imposing fire-sale externalities on other intermediaries by depressing the market valuations of CRE debt and underlying CRE properties.

Bottom line

Believe it or not, there are major issues on these larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology outlined here.