The Fed Was Blindsided By Its $200 Billion Loss

Our latest article on bank safety: The Fed Was Blindsided By Its $200 Billion Loss

The Fed recently released its financial statements for the third quarter. In this article, we're looking at the regulator’s balance sheet and the fact that the Fed was not apparently able to forecast its own financial position.

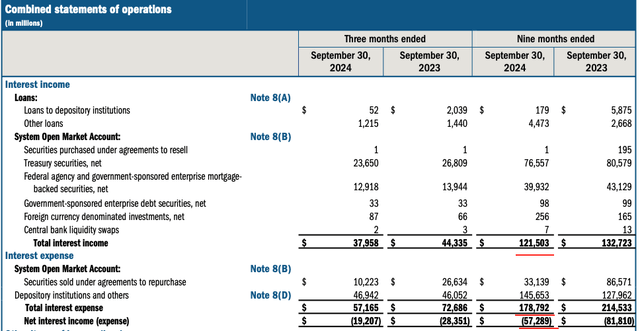

The regulator's interest income for the nine months of the year was $121.6B. The Fed’s interest expense was $178.8B. As a result, its net interest expense for 9M24 was $57.3B. The Fed’s total net interest expense declined YoY. However, it's still quite large.

The Fed

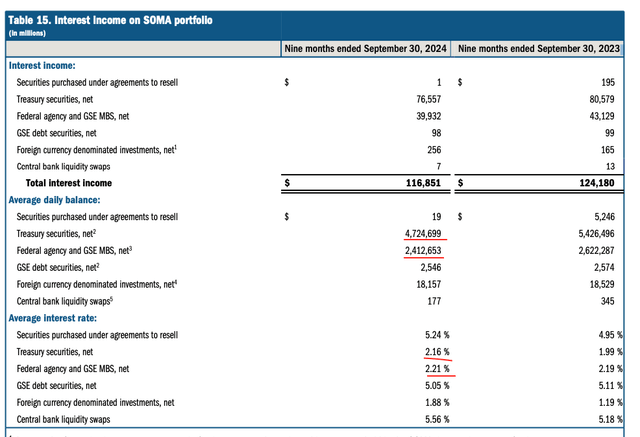

There were operating expenses of $7.1B, and, as a result, the Fed’s total net loss to the Treasury for 9M24 was $64.4B.

The Fed

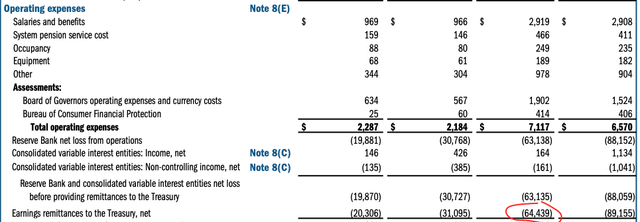

The Fed’s financial results give a lot of details about the regulator’s losses and its balance sheet structure. However, they're published with a time lag. If you follow our banking work, you know that the St. Louis Fed publishes data on the total Fed’s losses on a weekly basis. The Fed has been losing money since September 2022, and its total loss, as the chart below shows, reached $211B as of the end of November.

St. Louis Fed

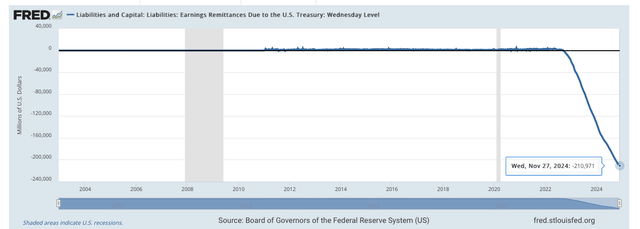

The reason for this significant loss is the Fed’s balance sheet. Here's a breakdown of the Fed’s interest income on the SOMA (System Open Market Account) portfolio with average daily balances and average interest rates.

The Fed

The Fed has $4.7T of Treasuries with an average yield of 2.16% and $2.4T of Federal Agency and GSE MBS, which have an average yield of 2.21%.

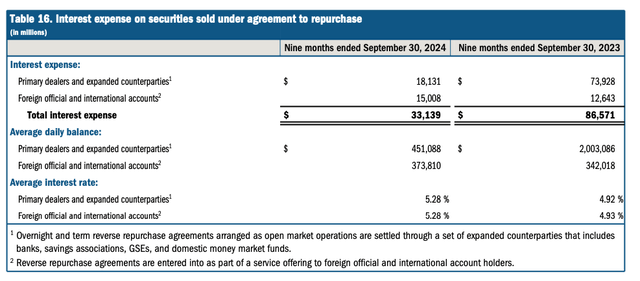

The table below shows the regulator’s interest expense in 9M24. 19% of its total interest expenses were expenses on securities sold under an agreement to repurchase. As shown below, the Fed was paying 5.28% on these instruments in 9M24.

The Fed

The rest of the regulator’s interest expense is what it's paying to depository institutions. According to the Fed, depository institutions earn interest at the interest on reserve balance (IORB) rate, which was 4.9% as of the end of September, and it's 4.65% now.

As such, for the nine months of the year, the Fed was receiving a 2.2% yield on its assets but was paying almost 5% on its liabilities. The November rate cut will help the Fed’s cost of funding, but only marginally.

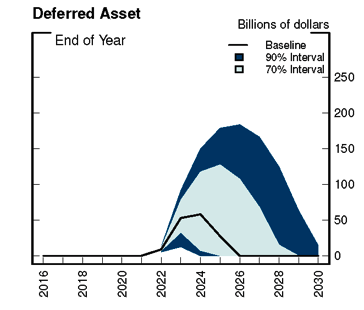

Notably, the Fed calls these losses a “deferred asset" according to its accounting methodology, which was introduced in 2010. This makes sense from the regulator’s perspective, as otherwise, with a total loss of $211B and a capital of $43B, the Fed would have negative equity of $168B.

Of course, given that these losses of $211B are real cash losses and a part of the U.S. budget deficit, they're quite important. But for us, who are focusing on finding safe banks in the U.S., it's very interesting to see that the Fed’s expectation about its balance sheet structure, net interest spread, and the total loss was so wrong.

In mid 2022, the Fed published an article titled “An Analysis of the Interest Rate Risk of the Federal Reserve’s Balance Sheet, Part 2: Projections under Alternative Interest Rate Paths." In this paper, the regulator examined how fluctuations in interest rates affect its financial result along with the unrealized gain or loss position of the SOMA portfolio.

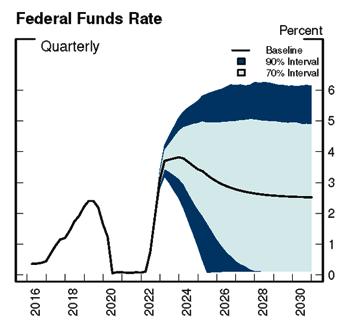

One of the regulator’s scenarios assumed that the policy rate would reach 6% in 2025-2026 and stay at this level until 2030.

The Fed

Surprisingly, even under this scenario, the Fed did not expect that its cumulative loss or a “deferred asset” would be more than $180B.

“While the deferred asset reaches a peak of about $60 billion in the baseline projection, the tail risk in these projections, represented by the upper edge of the dark-blue area, indicates that the deferred asset could reach as high as about $180 billion.”

The Fed

Given the Fed’s balance sheet and its net interest spread, which we have discussed earlier, the regulator’s loss is very likely to increase next year and will probably peak only in 2026 at a level of $300-$350B.

The Fed expected that the probability of its losses being larger than $210B under a sub-6% policy scenario was likely close to 1%. And a probability of a $300-$350B loss was probably virtually zero. A tail risk usually has a 5% probability rate, but when many analysts and mainstream financial media are talking about tail risks, they suggest simply ignoring them because of this extremely low probability. But this risk that has realized and led to a $211B loss for the Fed probably had a less than 1% probability. Yet, this is where we are now.

So, when you hear that analysts and financial media are saying that large U.S. banks are very safe because they have successfully passed all the Fed’s stress tests, remember that the regulator cannot even forecast its own financial position. As Alan Greenspan was once quoted as saying:

“We really can't forecast all that well, and yet we pretend that we can, but we really can't.”

So, again, if the Fed is unable to accurately forecast its own losses, do you really think you should be relying on them for any determinations regarding the health of the banking system as a whole?

Also, if a large U.S. bank fails, would it make any difference to you knowing that "it was a tail risk and a low-probability risk?" These numbers by the Fed show us that low-probability risks can be realized even in this environment, which is still relatively benign.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Review our due diligence methodology here.