The Fed Is A Paper Tiger

Please see our latest article on bank safety.

The Fed Is A Paper Tiger

It seems that even large banks were surprised that the Fed’s 2025 stress test scenarios will be easier compared to the past two years. If you follow our banking work, you know that there are warning signs in almost every lending segment. Even the Fed’s researchers have recently started raising concerns, warning that various issues could lead to a major banking crisis. Yet, the Fed has announced easier and less conservative assumptions for the 2025 stress tests.

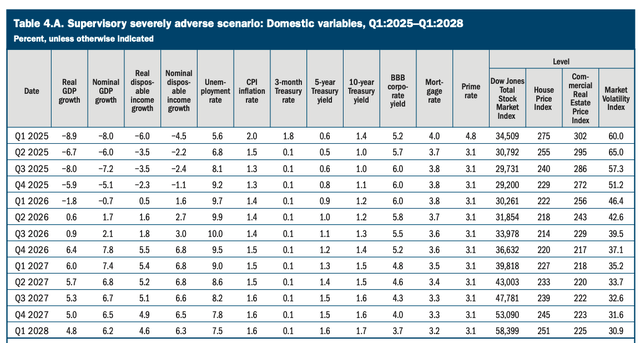

Here are the assumptions for the 2025 Fed’s severely adverse scenario:

The Fed

The scenario assumes that U.S. unemployment would peak at 10%, while home prices would fall by 33% and commercial real estate would decline by 30%. As you can see, the Fed also assumes a very short-lived, V-shaped recession. The DJIA Index would decline by 50% but with a quick rebound. For context, the DJIA lost approximately 89% of its value from its peak in September 1929 to its bottom in July 1932.

In addition, the 2025 scenario assumes a less sharp decrease in real GDP.

Here is what the Fed said about the 2025 assumptions:

The current severely adverse scenario features a slightly smaller increase in the unemployment rate in the United States compared to the 2024 severely adverse scenario. The current severely adverse scenario also features slightly smaller declines in house prices, which reflects the Scenario Design Framework’s response to the slightly lower ratio of nominal house prices to per capita disposable income at the end of 2024.

The current severely adverse scenario reflects a decline in commercial real estate prices that is 10 percentage points smaller compared to the previous year’s severely adverse scenario, recognizing that those prices have already declined by a little more than 10% relative to their most recent peaks and limiting the procyclicality in the stress tests.

The potential for spillover effects in asset markets and sharp changes in investor sentiment are captured by a decline in equity prices and an increase in corporate bond spreads, although these changes are less severe relative to last year’s scenario, reflecting less severe stress in commercial real estate markets.

The international component of the current severely adverse scenario shows a recessionary episode that, relative to last year’s severely adverse scenario, is the same for the euro area and less severe in all other countries or country blocs.

We are puzzled as to why the Fed has made its stress tests less stringent, especially in the commercial real estate segment. One possible reason could be the recent lawsuit against the Fed. As a reminder, the Bank Policy Institute and the American Bankers Association, both banking lobby groups, are suing the Fed over its annual bank stress tests. In particular, the bank lobby groups declared “that the Fed’s stress test regime is unlawful.” As a result, the lawsuit requested the following from the court:

- Vacate and set aside the 2019 and 2020 Fed actions that established the current stress-test regime;

- Declare the models and scenarios used in the 2024 stress tests, as well as those planned for the 2025 and 2026 stress tests, unlawful; and

- Require the Fed to subject the stress-testing framework, including its scenarios and models, to notice and comment before starting the 2026 stress tests.

Whatever the reason for the less conservative 2025 assumptions, we believe that the Fed’s stress tests have become a futile exercise, providing little value to retail depositors who want to know how their bank would perform in a major crisis.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Review our due diligence methodology here.