The Capital One/Discover Merger: Two Wrongs Don't Make A Right

See our latest article on bank safety, titled "The Capital One/Discover Merger: Two Wrongs Don't Make A Right."

Last month, Capital One (NYSE:COF) announced that it would acquire Discover (NYSE:DFS) in an all-stock transaction valued at $35.3B. Some experts said that the acquisition would create a much stronger entity. We disagree. We believe that such a transaction implies that both companies have major issues given the current stage of the credit cycle in the U.S. In this article, we will take a closer look at COF and DFS, given that both companies have recently released their 10-K reports.

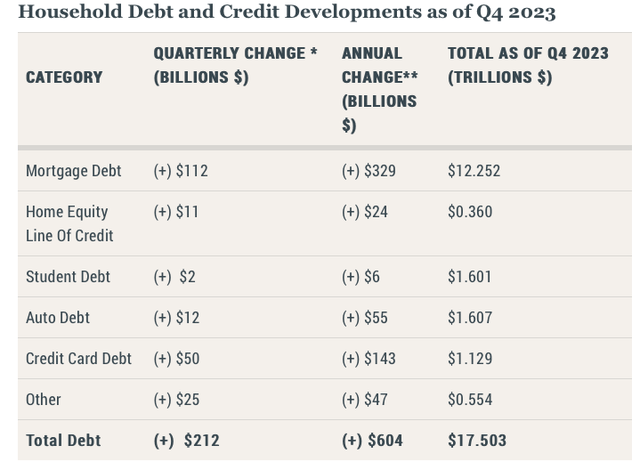

But before we begin analyzing those banks, let’s take a look at the total credit card segment in the U.S., as these loans are important for both COF and DFS. According to the latest household debt report, published by the Federal Reserve Bank of New York, credit card balances in the U.S. rose by 13% YoY in 4Q23 and reached $1.3T. We believe that pandemic-related savings are fading, but consumers want to continue spending more than they are earning. As a result, we see massive growth rates in credit cards.

NY Fed

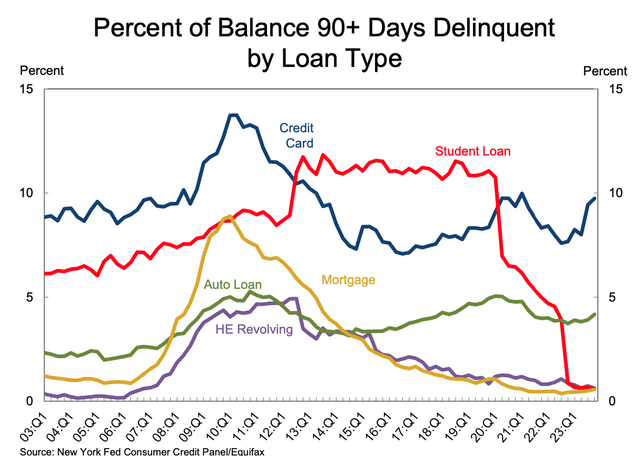

Recently, approximately 8.5% of credit card balances transitioned into delinquency. As the chart below shows, credit cards have the highest delinquency ratio among all the types of retail lending products.

NY Fed

According to Wilbert van der Klaauw, economic research advisor at the New York Fed:

"Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels. This signals increased financial stress, especially among younger and lower-income households."

So, in other words, the asset quality of credit cards is deteriorating pretty rapidly, despite the fact that the labor market is still very tight. As such, even a mild increase in the unemployment rate will likely lead to serious asset quality issues in the credit card segment.

Let’s go back to COF and DFS.

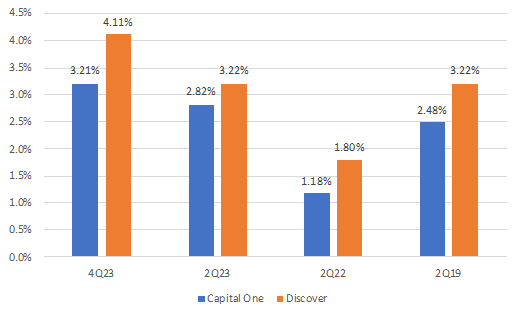

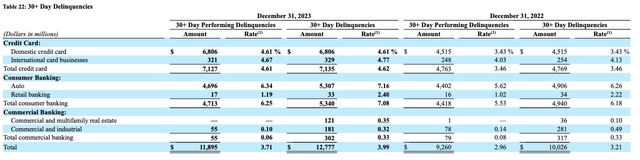

If we look at the latest results of COF and DFS, we'll see that charge-off ratios and delinquency ratios already are above pre-pandemic levels.

Capital One’s net charge-off rate was 3.81% in 4Q23, up compared to 2.82% in 2Q23, up compared to 1.18% in 2Q22, and up from 2.48% in 2Q19. This is a total net charge-off for the bank. If we look at COF’s credit cards, their charge-off rate already is around 5%.

DFS’s net charge-off rate was 3.99% in 4Q23, up from 3.22% in 2Q23, up from 1.80% in 2Q22, and flat compared to 3.22% in 2Q19.

Net charge-off rates

Company Data

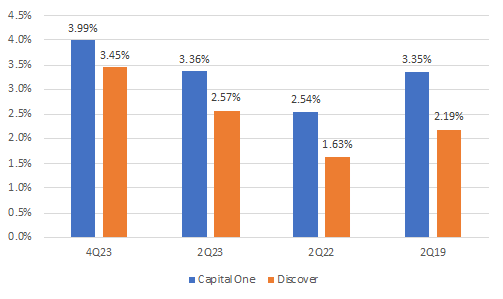

Capital One’s delinquency rate was 3.99% in 4Q23, up from 3.36% in 2Q23, 2.54% in 2Q22, and 3.35% in 2Q19. DFS’s delinquency rate was 3.45% in 4Q23, up from 2.57% in 2Q23, up from 1.63% in 2Q22, and up from 2.19% in 2Q19.

Company Data

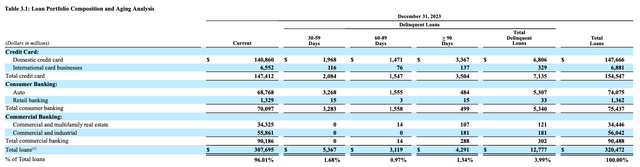

While Capital One is widely viewed as a credit card-focused lender, we note that as of YE23, credit cards accounted for 48% of its total loan book.

Company Data

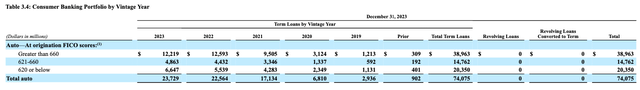

The second-largest segment of COF’s book is auto lending (23% of the total credit portfolio). The bank discloses three categories of FICO distribution for its auto portfolio: “Greater than 660," “621-660," and “620 or below." According to COF’s own definition, for auto banking, FICO scores of 620 or below are considered to be subprime.

Company Data

The national average FICO is currently 718. The disclosure provided by COF suggests that at least 47% of borrowers have a FICO lower than the national average, and 27% of borrowers are subprime.

Unsurprisingly, the weak FICO of COF’s auto loans has already resulted in a rise in delinquencies. As the table below shows, auto loans’ 30-day-plus delinquency ratio was 6.34% as of YE23, which is even higher than the credit cards’ respective metric.

Company Data

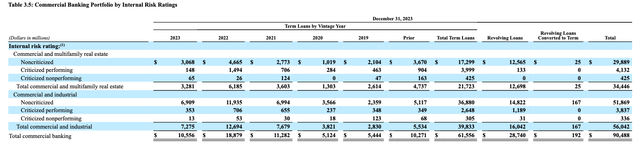

Finally, COF has a very weak commercial book. A breakdown of the commercial book based on the bank’s own rating system shows that if we sum up “criticized performing loans” and “criticized nonperforming loans,” then 13.2% of commercial and multifamily real estate books have signs of credit quality issues. COF defines criticized performing loans as “loans in which the financial condition of the obligor is stressed, affecting earnings, cash flows, or collateral values,” and criticized nonperforming loans are defined as “loans that are not adequately protected by the current net worth and paying capacity of the obligor or the collateral pledged.” In other words, the share of problem loans in this segment is as high as 13.2%. This is a horrific number, even for a struggling CRE segment.

If we look at the bank’s commercial and industrial book, then criticized performing loans and criticized nonperforming loans together correspond to 7.4% of the portfolio, which also is very high for the current environment. As a reminder, COF’s total commercial book accounts for 28% of its credit portfolio, which is quite significant.

Company Data

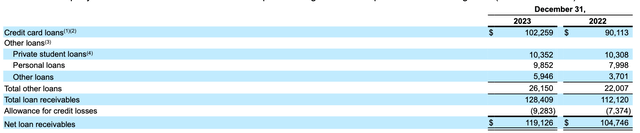

And what about Discovery? Here's a breakdown of its loan portfolio.

Company Data

As of YE23, credit cards accounted for 80% of its total loan book. As we said earlier, DFS’s current total charge-off rates are even worse than those of COF. In addition, DFS had a $10B portfolio of student loans. Last November, the company announced that it had started exploring the sale of its student loan portfolio. However, unless DFS offers a significant discount, we do not think that the company will find a buyer soon.

Bottom Line

So, let’s summarize what we know about this acquisition. Asset quality metrics of Capital One’s credit cards are deteriorating rapidly, and the bank also has a low-FICO auto book with high delinquency ratios. In addition, it has a sizable commercial book with horrific bad-loan ratios. As for Discovery, its credit card portfolio is also seeing asset quality issues, and, in addition, the bank has a $10B student loan portfolio, which, unsurprisingly, no one wants to buy.

I must warn you that COF and DFS are not alone with regard to major concerning issues sitting on the balance sheets of those banks. I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. The substance of our analysis suggests that the future is not looking too good for the larger banks in the United States, details for which can be read here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Our due diligence methodology is outlined here.