The Biggest Systemic Risk To The Banking System

The Biggest Systemic Risk To The Banking System

By Avi Gilburt, with Renaissance Research

Klass Knot, the head of the Financial Stability Board (FSB), which is the world’s financial stability watchdog, has recently issued a statement about the regulator’s key areas of concern. Notably, this statement was almost fully focused on vulnerabilities in non-bank financial intermediation (NBFI), or the so-called shadow lenders.

“Vulnerabilities in non-bank financial intermediation (NBFI), including pockets of hidden or excessive leverage, remain a potential source of systemic risk. Combined with rich asset valuations in some markets, these vulnerabilities raise the potential for sharp price corrections in the event of a shock. Such shocks could be more likely amid heightened geopolitical uncertainty, which highlights the importance of enhancing international collaboration.

Recent incidents of market stress and liquidity strains have demonstrated that NBFI can create or amplify systemic risk. Many of the underlying vulnerabilities that contributed to these incidents are still largely in place, leaving the global financial system susceptible to further shocks.

Addressing leverage-related vulnerabilities in NBFI is another important aspect of our work to promote financial stability. Non-bank entities have been taking on additional leverage through off-balance sheet exposures, which have grown significantly over the past decade.”

We have published several articles on shadow lenders and the US banks’ exposure to these entities, as well as issues with the off-balance sheet exposure of both the banks and the shadow lenders. In fact, we highlighted off-balance sheet exposures as a major issue more than two years ago.

The growth of shadow lenders has been increasingly strong over the past decade; however, the regulators have only started to discuss this issue of late. In addition to the FSB’s statement, there was also an interview with Elizabeth McCaul, a member of the European Central Bank’s supervisory board, who said that the “remarkable” growth of non-banks was the biggest threat to the stability of the Eurozone’s financial system. Finally, Michael Hsu, the CEO of the Office of the Comptroller of the Currency, which is one of the largest regulators in the U.S., told the Financial Times when asked about shadow banking lenders that “he thought the lightly regulated lenders were pushing banks into lower-quality and higher-risk loans”:

"We need to solve the race to the bottom,” said Hsu. “And I think part of the way to solve it is to put due attention on those non-banks.”

The Archegos Capital case showed that even the bankruptcy of one shadow lender could lead to major issues at the largest global banks. As a reminder, the banks posted almost $10B in losses from the default of Archegos Capital, but Credit Suisse suffered the most, as the bank recorded $5.5B in losses on a notional exposure of over $20B. At the time, Credit Suisse’s tangible equity was CHF38B. In other words, its exposure to Archegos Capital was more than half of its equity. The default of Archegos Capital was one of the key reasons for Credit Suisse’s collapse and its acquisition by UBS.

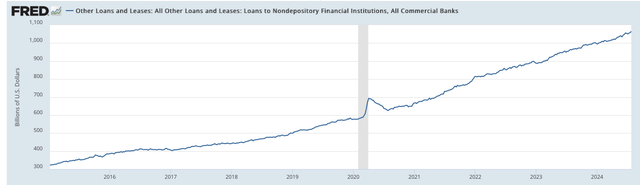

According to the Fed, loans to shadow lenders granted by U.S. banks reached $1.15T as of the end of June. Lending growth to these entities has been increasingly strong over the past decade. As the chart below shows, these loans skyrocketed by more than 200%, from around $300B as of January 2015 to $1.1T as of June 2024. Those loans now account for almost half of the sector’s total equity

St. Louis Fed

By comparison, total loans and leases in bank credit have increased by about 60% over the same time period, or less than 60%, excluding lending to shadow bankers.

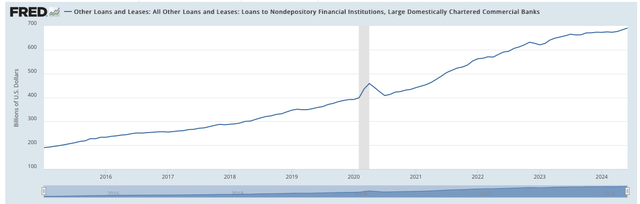

Probably the most interesting part of this story is that loans to shadow bankers granted by the 25 U.S. largest banks have grown at an even higher pace, as they have increased by more than 265% since January 2015. As the chart below shows, almost 70% of these loans to shadow banking intermediaries were granted by the 25 U.S. largest banks.

St. Louis Fed

Bottom Line

Believe it or not, there are more major issues on larger bank balance sheets relative to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we are not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it is absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And, what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks, including the three just noted, in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bancorp, Inc. (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. You are welcome to use our due diligence methodology outlined here.