New York Community Bancorp: Just The Tip Of The Upcoming Banking Crisis Iceberg

See our latest article on bank safety, titled "New York Community Bancorp: Just The Tip Of The Upcoming Banking Crisis Iceberg."

In our banking articles, we have been discussing issues in the CRE loan space for more than 18 months, warning readers that this lending segment could likely lead to a major crisis in the U.S. banking system. Several important events that occurred last week have further confirmed our view that a CRE-induced crisis is likely inevitable.

First, New York Community Bancorp (NYSE:NYCB), which is a top-40 U.S. bank by total assets, reported a loss of $252MM for 4Q due to a sharp spike in loan loss provisions, which were $552MM for 4Q. By comparison, these provisions were just $62MM in 3Q. According to the bank, “the increase is primarily attributable to higher net charge-offs, as well as, to address weakness in the office sector, potential repricing risk in the multi-family portfolio, and an increase in classified assets”. As a result, NYCB cut its dividend by 71%, and the bank’s share price has fallen by almost 50% in just two days following the results.

The Financial Times reported that Nicholas Munson, head of risk at NYCB, left his post shortly before NYCB released its 4Q results. In addition, Bloomberg reported that “officials from the Office of the Comptroller of the Currency held tense, private discussions with NYCB’s management."

It's worth noting that this huge reserve build-up was primarily due to just two loans: A co-op loan and an office loan. One can just imagine how bad risk management is at many U.S. banks if only two loans can lead to a large loss and a huge dividend cut.

Another thing to note is that NYCB has relatively low exposure to CRE loans, which accounts for 12% of its total lending. As such, U.S. banks with a higher exposure to CRE lending will very likely face much worse issues soon. For example, here's what Wells Fargo’s CEO said when he was asked about CRE-related issues:

I think, in terms of your broader point, it's a long movie. We're still - we're not - we're past the opening credits, but we're still in the beginning of the movie. And so it's going to take some time for this to play out. And as I noted, it'll be somewhat of an uneven and episodic sort of nature to the charge offs and as you work through this, because every property has a different timeline in terms of events that it needs to sort of work through. So I do think that we've got a while for this to play out through the system.

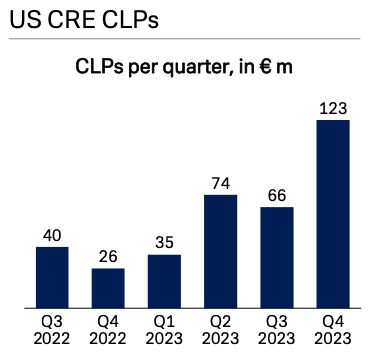

Deutsche Bank (DB) also reported 4Q results last week. The bank’s loan loss provisions were the highest since 2Q20, mainly due to U.S. CRE loans. As the chart below shows, U.S. CRE CLPs almost doubled in 4Q compared to 3Q.

Company Data

Furthermore, DB made the following comment regarding the U.S. CRE space, which looks quite concerning:

Refinancing remains main risk when loans with lower debt service coverage ratio and reduced collateral values reach maturity / extension dates, often requiring modifications including additional equity to qualify for refinancing

It may sound quite unexpected, but even Asian banks started to post losses due to U.S. CRE lending. Japan's Aozora Bank announced that it would post its first annual loss since 2009 due to massive provisions that the bank booked due to a deterioration of its U.S. CRE credit portfolio. The bank’s share price fell by almost 20%.

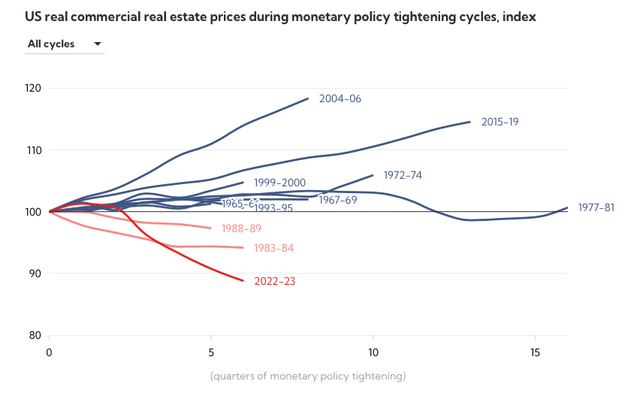

Another concerning study came from the IMF. The agency has published a report saying that U.S. commercial real estate is currently seeing an unprecedented fall in prices. As the chart below shows, the current price decline is the steepest in at least half a century.

IMF

Finally, we would like to highlight that U.S. banking regulators have changed its rhetoric regarding the banking system. The FDIC, which is usually very optimistic about the banking sector and prefers to ignore red flags, has recently made the following statement:

Looking more closely at commercial real estate portfolios, we are beginning to see concerning trends in non–owner–occupied property loans. The volume of noncurrent non–owner occupied CRE loans increased by $4.1 billion, or 36.4 percent, quarter over quarter. In addition, these loans had a noncurrent rate of 1.31 percent in the third quarter, up from 0.96 percent last quarter and 0.54 percent a year ago. This is the highest noncurrent rate reported for this loan portfolio since third quarter 2014.

In addition, the FED removed the phrase “The U.S. banking system is sound and resilient” from its latest FOMC statement. Moreover, Jerome Powell recently said that commercial real estate “feels like a problem we'll be working on for years. It's a sizable problem.” These changes in the rhetoric from the FDIC and the Fed may suggest that the regulators are gradually preparing markets and depositors for a banking crisis, which is likely imminent.

Now, to end this missive, I want to post a personal and quite ironic story.

For the last two years, I have been begging my parents to let me know what banks they are in, so I can help them move their money to safer banks. And, they have simply refused, since they have been in the same banks forever.

Well, over the last several months, my father has been having serious health issues which have made it clear to him that he can no longer live in the home in which my parents have been living for the last 55 years. So I have been heavily involved in moving them to an assisted living facility in Florida. I have been managing their house sale, finding and contracting their ALF apartment, arranging new doctors for them, and all the other coordination that needs to be done for such a move. So, they finally told me earlier this week about the banks in which they are housing their money, since we have to move some of their money to a bank they can easily access in Florida.

Well, it turns out that a sizeable amount of their money is in... yes, you guessed it... New York Community Bank! Yes, this is a story in my own family. And, they had no clue as to what was going on with the bank. So, when I told my father that the stock of the bank dropped about two-thirds over the last six months, and that it dropped by 50% in the last few days alone, he was speechless. Needless to say, at my strong urging, they moved their money to another bank this week.

As the banking crisis that I expect in the coming decade develops further, I think most families will likely experience a story such as this, since most people do not follow the financial news as closely as many of you who read financial news regularly. And I would suspect that many of you who do read financial news regularly will also be affected by what I'm seeing down the road, as many people are held back from being proactive by inertia. Don't be one of those people!

Bottom Line

CRE lending is only one of many issues that the U.S. banking system is currently facing. In our previous articles, we also discussed various problems with credit cards, auto loans, commercial lending, and non-U.S. loans. There also are many issues with liquidity, securities books, derivatives, and off-balance sheet exposure which we have outlined as well. Whereas the 2007-2009 financial crisis had one main issue which caused the banking melt-down at the time, we are currently heading into an environment with multiple issues sitting on many bank balance sheets.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were able to identify the exact reasons in a public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Our due diligence methodology is here.