Larger Banks Have Even Bigger Risks Than Smaller Ones

See our latest article on bank safety, titled "Larger Banks Have Even Bigger Risks Than Smaller Ones."

We have written a lot on why it's a huge misunderstanding to think that the largest U.S. banks will be the safer ones in a systemic crisis scenario. Over the past two years, we have published articles on most of the larger U.S. banks. We also have recently written an article on large banks exposure (around $700B) to high-risk shadow banking intermediaries. In addition, a couple of weeks ago, the Fed introduced four new shocks to its stress tests, which will be applied only to the largest and the most complex banks.

In this article, we would like to discuss collateralized loan obligations (CLOs), another major issue for the U.S. largest banks.

For starters, a CLO is a security backed by a pool of debt. Most CLOs are backed by loans granted to private equity firms, venture capital funds, and corporations with low credit ratings. Given that these securities are much riskier than traditional corporate loans, they have higher yields. CLOs are very similar to mortgage-backed securities - MBS, which triggered the Great Recession. The only difference between them is the type of underlying loan within the basket.

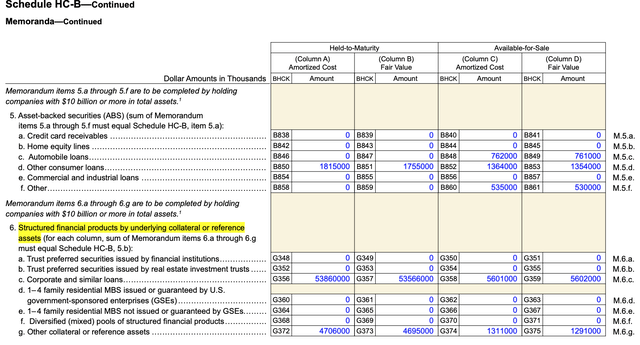

It's a really difficult quest to find where U.S. banks disclose amounts of CLOs on their balance sheets. Obviously, you will not find this data in the bank's investor presentations or in their press releases, given the high risk represented by these financial instruments. The banks disclose CLO-related data in Schedule HC-B of the Form Y-9C filing under the line "structured financial products backed or supported by corporate and similar loans." For example, here's how this disclosure looks for JPMorgan (JPM).

Company data

As of the end of 2023, JPM had $60B of structured financial products backed by corporate and similar loans, of which $54B were held-to-maturity and $5.6B were available-for-sale. We can see that there's almost no difference between "fair value" and "amortized cost" as these securities are not tradable. The $60B is a significant amount even for one of the largest U.S. banks given that it is almost 20% of its total equity. JPM is the largest holder of CLOs in the U.S. banking system.

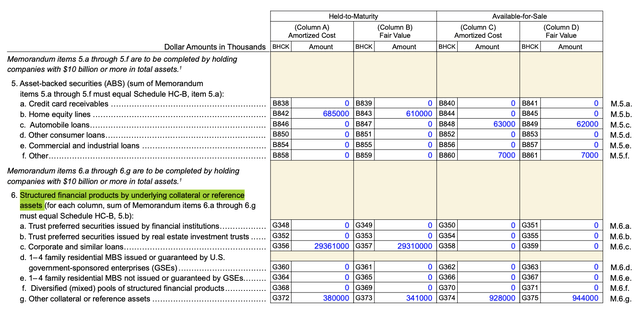

The second largest holder of CLOs is Citigroup (C), which had $29.7B of these securities as of the end of 2023. The $29.7B is 16% of Citi's total equity.

Company data

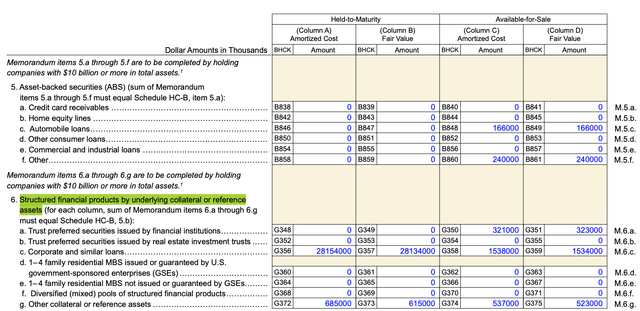

The third-largest holder is Wells Fargo (WFC), which had $29.4B of these securities as of the end of 2023, which corresponds to 14% of Wells' equity.

Company data

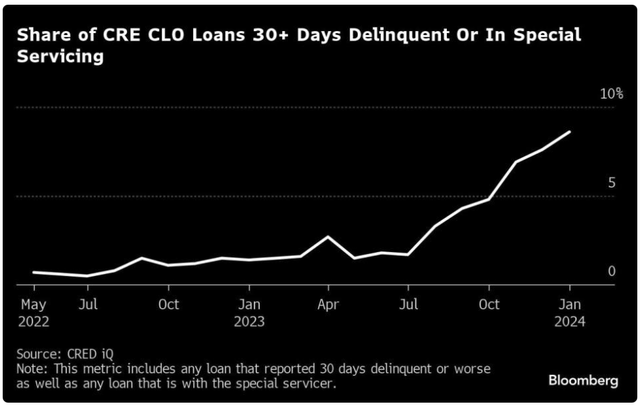

Similar to shadow banking-related loans, CLOs are a complete black box as pools of corporate loans are not disclosed publicly. But, as we said earlier, those are usually the riskiest loans. Bloomberg has recently reported that about 8.6% of CRE loans bundled into CLOs were 30-plus days delinquent as of January 2024. This is much higher than the respective metric of traditional CRE loans.

Bloomberg

Furthermore, while CLOs are already very risky, U.S. banks are increasing the riskiest segments of these instruments. This week, Bloomberg reported that Goldman Sachs (GS) and Morgan Stanley (MS) have increased their underwriting of the so-called equity portions of CLOs, which are riskiest parts of these securities.

Bottom Line

If you still think that the largest banks will be the safest in a systemic crisis scenario, despite all our previous articles, here's another issue of which you must be aware. Consider that there was one main issue which caused the Financial Crisis of 2007-2009. Currently, there are multiple similar risks on the books of the largest banks.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Our due diligence methodology is outlined here.