JPMorgan And Bank of America Are Calling The Fed's Bluff

Our latest article on bank safety: "JPMorgan And Bank of America Are Calling The Fed's Bluff"

The Fed has recently announced the results of its annual bank stress tests. We have written a lot about why the Fed's stress tests do not reflect how the actual financial conditions of U.S. banks would look under a sharp recession scenario. It seems we are not alone.

Just several hours before the Fed announced its results, JPMorgan (JPM) issued a press release, saying that, under its own assessment, the benefit in Other Comprehensive Income (OCI) appears to be too large. As a result, JPM’s own stress tests show that the bank’s losses would be higher than those disclosed by the Fed.

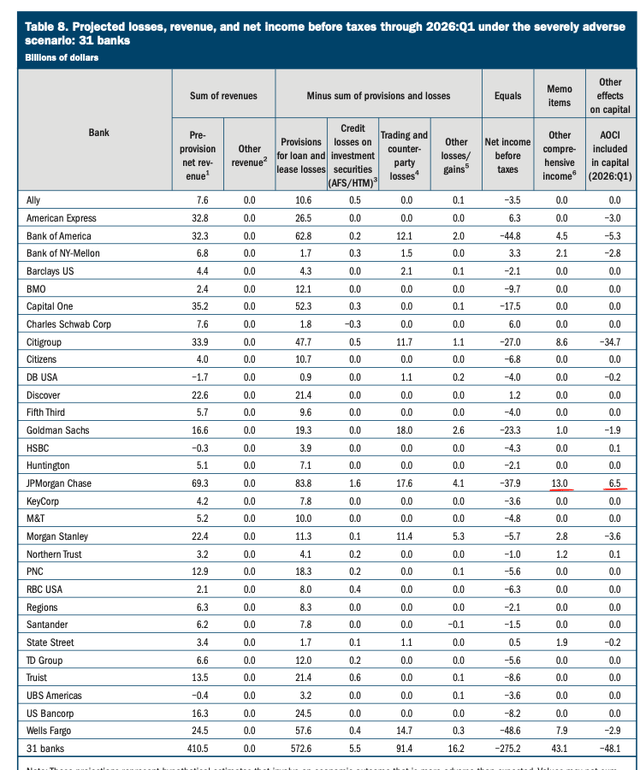

Indeed, as the table below shows, JPM’s OCI under the severely adverse scenario looks very large, especially when compared with other banks.

The Fed

As a reminder, last year, Bank of America (BAC) made a similar statement, saying that there were significant discrepancies between its own calculations and the 2023 stress test results released by the Fed.

First, BAC's internal stress test showed that the bank would post a loss of $52.2B under the severely adverse scenario, while the Fed expected the bank to lose only $23.0B. Second, BAC estimated that its OCI would be $12.5B, while the Fed's tests showed it would be $22.3B. Due to a combination of a bigger loss and lower OCI, BAC expected its CET1 (Common Equity Tier 1) capital ratio to fall to 8.3%, while the Fed said the ratio would decline to 10.6%.

This indicator is calculated by dividing a bank’s CET1 (Common Equity Tier 1) capital by its total RWA (risk-weighted assets). For further information, according to the Basel standards, CET1 capital is the highest quality of regulatory capital as it absorbs losses immediately when they occur. Basically, the CET1 capital shows a bank's ability to weather a financial crisis and maintain its solvency.

In our view, these announcements by JPM and BAC should cause many to question the credibility of the Fed’s stress tests. These significant discrepancies imply that the Fed is much less conservative than the banks that it regulates. Needless to say, a banking regulator should be as conservative as possible in such an important exercise as a stress test.

As such, we're not going to discuss the results of individual banks. Instead, we’d like to take a closer look at the reasons why the 2024 test shows that large banks would endure greater losses compared to last year's test. According to the Fed, the 2.8 ppt decline in the aggregate CET1 capital ratio projected in the 2024 stress test is larger than the 2.5 ppt decline in the 2023 stress test.

Here is an official explanation from the regulator:

The larger decline in this year's aggregate capital ratio owes significantly to:

• Growth in credit card balances and a rise in credit card delinquencies, which increase projected losses on consumer credit;

• Banks’ corporate credit portfolios have shifted toward riskier loans resulting in a larger share of non- investment grade corporate credit and a significant increase in the projected loss rate); and

• Lower noninterest income in recent years and higher noninterest expenses, even after excluding FDIC special assessments, resulting in lower projected noninterest net revenue

We have been discussing these risks (and others) for more than two years, so anyone reading our banking articles over this time period is well aware of them. While we were analyzing these major issues, we were also scratching our heads as to why banking regulators, including the Fed, continue to largely ignore them. Finally, it seems that the Fed has started to recognize some of these risks. However, the assumptions that the regulator used look very questionable, to put it mildly.

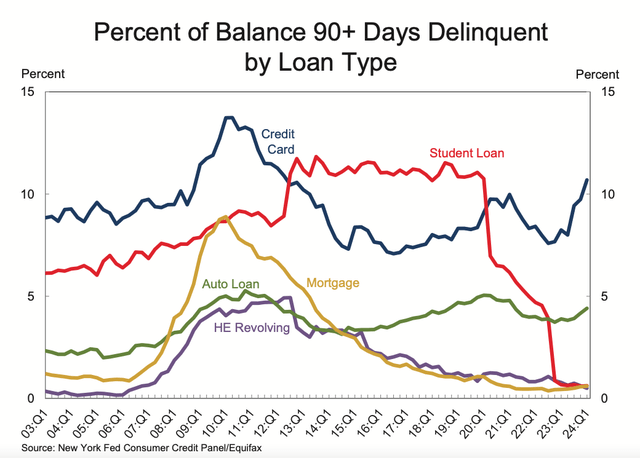

First, the Fed highlighted high credit card growth and a rise in the segment’s delinquency ratio. We have written a lot about this issue, and even more than two years ago, our analysis demonstrated that this lending segment would very likely face major issues. The Fed has just begun talking about it.

Under its severely adverse scenario, the Fed projects a 17.6% loan loss rate in credit cards. Of course, for those who are following our banking work, this number looks very low. As of the end of 1Q24, the 90+ day delinquency ratio in credit cards was already above 10%. According to the Household Debt Report published by the NY Fed, in the first quarter, 8.9% of credit card balances transitioned into delinquency, and 6.9% of credit card balances transitioned into serious delinquency.

NY Fed

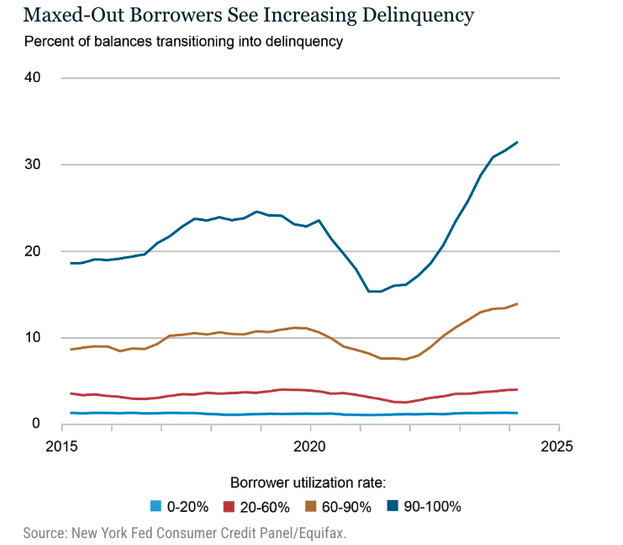

Moreover, there was a huge increase in the transition ratio among borrowers with a 90%–100% utilization rate and also quite a remarkable increase among borrowers with a 60%–90% utilization rate. We discussed this major issue in one of our previous articles.

NY Fed

So, what the Fed is doing in the credit card segment is not a stress test under a severely adverse scenario. It's not even a stress test under a negative scenario, as the regulator is simply extrapolating the current trends. Indeed, at these transition rates, the projected Fed’s default rate will likely be reached by the end of next year or even sooner.

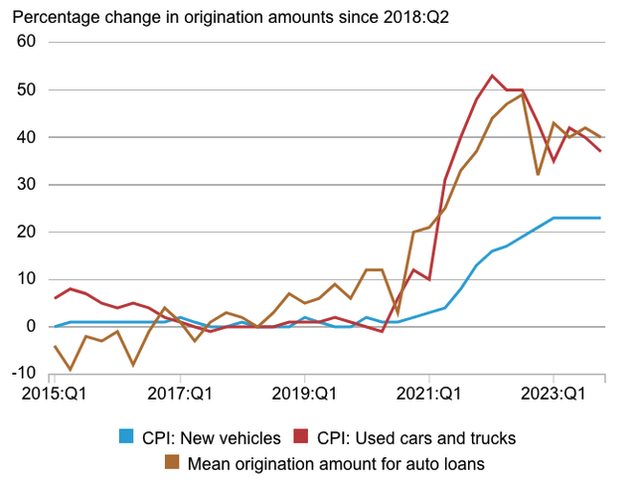

Another thing worth noting is that the Fed largely ignores looming risks in the car lending segment. According to the Household Debt Report published by the NY Fed, 7.9% of auto loans transitioned into delinquency in the first quarter. This loan segment is under significant pressure due to a massive increase in the mean origination amount for auto loans, driven by a 50%-plus CPI in used cars. We have published an article on this topic.

NY Fed

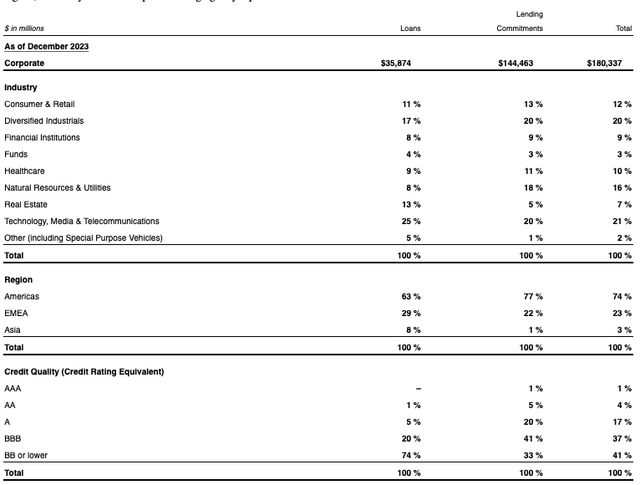

The second issue the Fed has mentioned is a larger share of non-investment-grade corporate credit. Again, we have discussed this issue a lot. For example, here's a table from Goldman Sachs’ (GS) 2023 10-K. As you can see, 74% of GS’s outstanding corporate loans and 41% of total lending commitments are non-investment grade.

Company Data

Those are really high numbers, and many large banks have similar significant exposure to non-investment-grade borrowers. Yet, the Fed projects only an 8.1% loan loss rate in the commercial and industrial segment under its severely adverse scenario.

The third risk the Fed noted is that “under stress, noninterest expenses tend to be persistent, while noninterest income tends to fall." It's a bit odd that the regulator mentioned this only now, as almost all crises showed that noninterest income is very sensitive to macroeconomic changes, while noninterest expenses decline at a lower rate. For example, in our article on U.S. Bancorp (USB), we showed that, in contrast to what many are saying, a high share of non-interest income is a significant risk in a crisis environment.

Another thing worth noting is what the Fed is saying about CRE lending:

The projected CRE loss rate in the 2024 stress test is the same as the projected loss rate in the 2023 stress test (8.8%).

This statement basically means that the regulator is ignoring all the negative changes that have happened in the CRE segment over the past 12 months.

For example, Aareal Bank, a German banking group, reported that 25% of its U.S. office loans had defaulted in the last quarter of 2023. The CFO of Manulife, a Canadian life insurer, said that the value of its U.S. office investments had fallen by 40% from a pre-pandemic peak. Also, there was a study published by a large group of researchers from USC, Columbia, Stanford, and Northwestern. The paper said that around one third of all CRE loans and the majority of office-related loans may encounter substantial cash flow problems and refinancing challenges.

As a result, researchers concluded that the banking industry could face a range of 10% to 20% default rates on CRE loans, i.e., levels that are comparable to or even higher than those seen during the Great Recession. Yet, the Fed projects an 8.8% default rate in the CRE space under its severely adverse scenario.

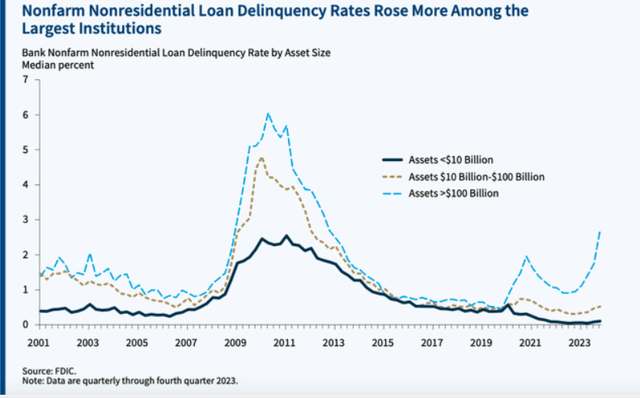

Even the FDIC has recently said that the largest banks, which are being tested by the Fed, posted the sharpest increase in the CRE loan delinquency ratio.

FDIC

Moreover, the FDIC also said that an estimated $1.6T in CRE loans will mature between 2024 and 2026. More than half of these maturing CRE loans are held by banks and are predominantly loans to finance nonfarm nonresidential properties, which include office loans. Importantly, large office loans (loans over $100MM), which are obviously mainly granted by bigger banks, had the lowest refinancing success rate among CRE loans in 2023. This suggests that larger banks will likely face very significant issues in 2024–2026, when these large office loans will need to be refinanced.

Furthermore, within this recent stress test, the Fed has also ignored many issues of larger banks, which we have previously discussed in prior articles, such as loans to shadow bankers, a rising exposure to CLO (collateralized loan obligations), a high share of non-U.S. lending, and others.

Bottom Line

We believe this article is another reminder that you should do your own due diligence and not rely on the Fed’s stress test.

So, I want to take this opportunity to remind you that we have reviewed many larger banks, including the four noted, in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bancorp (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. You are welcome to use our due diligence methodology outlined here.