ECB Warns That REITS Could Take A Big Hit

Our latest article on bank safety: ECB Warns That REITS Could Take A Big Hit

Last week, we published an article on the U.S. CRE lending and the recent study by the NY Fed, in which the regulator is warning that the banks’ sluggishness in recognizing bad loans, which is often called the extend-and-pretend behavior, has led to an increasing volume of CRE loans set to mature in the near term, which represents a major financial stability risk. According to the NY Fed, this could lead to a large and sudden capital hit for banks and, eventually, to a deposit run and a fire sale of CRE debt and underlying CRE properties.

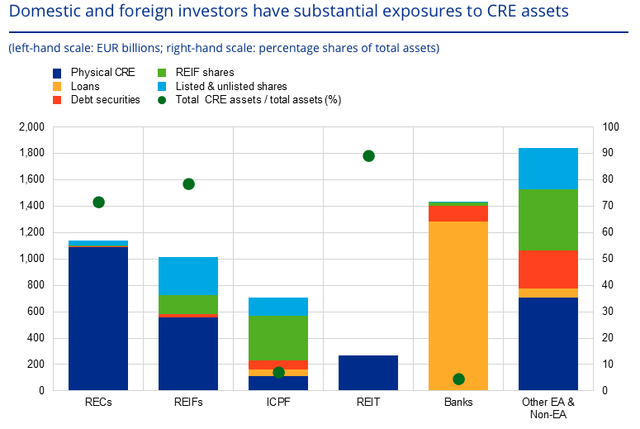

Interestingly, the European Central Bank (ECB) has also published a study about the EU CRE space. According to the ECB, the segment’s credit quality is visibly deteriorating, with the NPL ratio doubling since the start of the most recent monetary tightening cycle. In particular, the European regulator highlights that several sectors, such as real estate companies, real estate investment funds, and real estate investment trusts, have large exposures to the CRE segment and structural vulnerabilities that could amplify CRE-related shocks. Based on the current indicators and the past experience, the ECB concludes that the CRE lending segment could have serious implications for financial stability in the euro area.

So why do we think that this ECB study is important for the U.S. banks? The following chart is giving us some hints.

ECB

The ECB shows that non-EA (non-euro area) investors have very large exposure to CRE assets. The European regulator does not provide a breakdown by country, but there are likely a lot of investors from the U.S. in that category. Of course, we are not saying that U.S. investors have EUR1.8T of European CRE assets, as there are also very likely investors from China and the Middle East in the “non-EA” category. With that being said, the financial statements of the largest U.S. banks show that they have massively increased their lending exposure to Europe over the past decade.

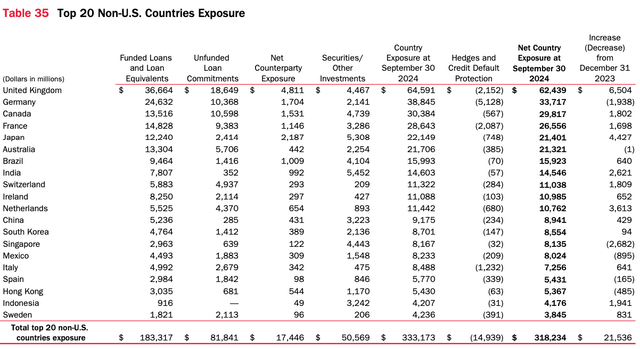

Below is a table from Bank of America’s (BAC) latest 10-Q.

Company Data

As we can see, BAC’s second largest non-U.S. country exposure was Germany, and, based on that table, the bank’s total exposure to the euro area is nearly $100B. By comparison, BAC’s CET1 capital was $200B as of the end of 9M24.

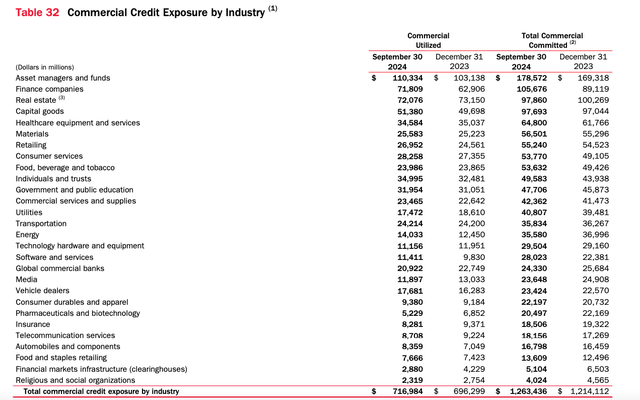

It is important to note that a loan to a real estate company or a real estate investment trust is classified as a commercial loan, not as a CRE loan. As such, CRE-related exposure that the largest U.S. banks disclose is somewhat misleading. Let’s look at BAC again.

Company Data

A breakdown of commercial loan portfolios by industry shows the BAC’s largest exposures are to asset managers and funds, finance companies, and real estate. All of these three sectors likely have exposure to the CRE segment. And, as mentioned earlier, similar to other largest U.S. banks, BAC classifies them as commercial loans.

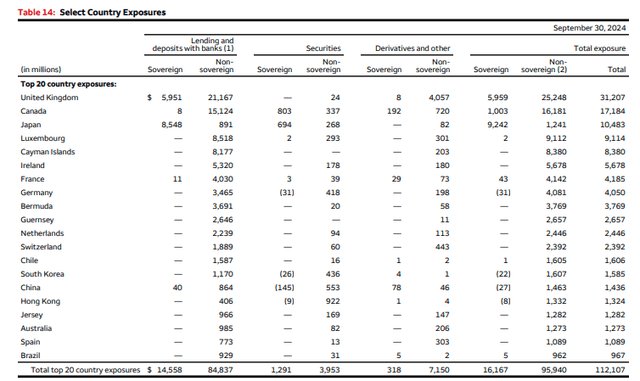

Below is a table from Wells Fargo's (WFC) latest 10-Q. WFC also has exposure to the euro area, although it is smaller compared to BAC. WFC’s total top-20 country exposure is $112B. By comparison, the bank’s CET1 capital (core capital equity) was $138B. Therefore, their top-20 country exposure is almost equal to its core capital equity.

Company Data

Needless to say, only the largest U.S. banks provide loans to non-U.S. companies, including European ones, as smaller community banks are not involved in international activity for obvious reasons. This is yet another risk sitting on larger US bank balance sheets which is not seen on those smaller – better capitalized - banks we are suggesting to our clients.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology outlined here.