Danger Sign: Shadow Banking Loans Now Exceed Bank Equity

New article by our team: Danger Sign: Shadow Banking Loans Now Exceed Bank Equity

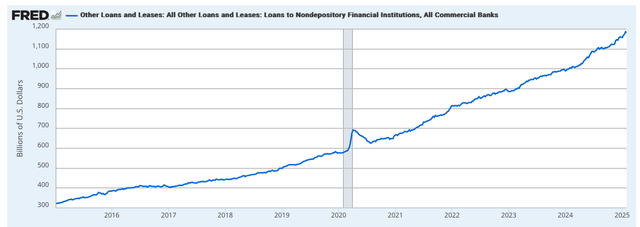

We recently published an analysis of the sector’s loan growth results for the full year of 2024, wherein we highlighted that the total credit portfolio of the sector increased by 2% YoY. However, the majority of this growth was driven by loans to shadow bankers, which rose by 15% YoY. By comparison, residential real estate loans grew by 2% YoY, while commercial and industrial lending increased by 1%.

Loans to shadow bankers have recently reached $1.2T.

St. Louis Fed

As we have stated on multiple occasions, these figures represent only on-balance sheet exposure, while a significant amount of loan commitments are off-balance sheet.

The Federal Reserve Bank of Boston has recently published a study examining both on-balance and off-balance sheet exposures of the 31 largest banks that participated in the Fed’s 2024 stress test.

According to the study, as of the third quarter of 2023, loan commitments to shadow bankers by these largest banks totaled $2.2T, accounting for 32% of their total loan commitments. By comparison, the total equity of the sector—which includes not only these 31 banks but also the broader banking system—was also $2.2T.

As such, as of Q3 2023, the total equity of the banks participating in the 2024 stress test was already lower than their loans to shadow bankers. Given that on-balance sheet loans to shadow bankers have increased by nearly 20% since Q3 2023, and assuming off-balance sheet loan commitments have grown at the same rate, total loan commitments to shadow bankers from the largest banks are now even higher. This makes shadow banking lending one of the largest segments—and, for some, already the largest—of these banks' credit books.

Notably, last week, the Fed released hypothetical scenarios for its 2025 stress test. The regulator announced that the 2025 exploratory analysis will examine the risks posed to banks by nonbank financial institutions (NBFIs), which is the formal term for shadow bankers. The Fed mentioned that credit commitments to shadow bankers reached approximately $2.1T in the third quarter of 2024 at large banks. While this estimate is lower than the one provided by researchers at the Federal Reserve Bank of Boston, it is still highly significant.

In its press release, the Fed stated:

"This growth poses risks to banks, as certain NBFIs operate with high leverage and are dependent on funding from the banking sector."

If you have been following our work on banking, you are aware that we have been discussing this issue for several years. While the Fed will now begin examining shadow bankers, this decision is long overdue and may be too late, especially considering that loans to shadow bankers already account for a third of the largest banks' credit books and exceed their total equity.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets.

These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to review and utilize our due diligence methodology here.