Credit Card Delinquency Approaching Great Recession Peak Is Major Risk For Banks

Credit Card Delinquency Approaching Great Recession Peak Is Major Risk For Banks

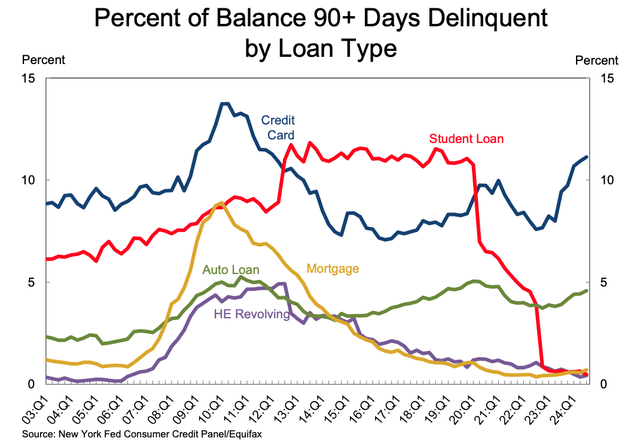

According to a new report on household debt, which was published by the NY Fed last week, credit card balances increased to $1.17T, 8.1% above the level a year ago. More importantly, as the chart below shows, the share of delinquent credit cards has reached the highest level since 2012. This share is now just around 300 bps below the peak, which was seen during the Great Recession.

NY Fed

Under the current economic conditions, which are still relatively benign for households, the GFC peak will be likely surpassed in late 2025–early 2026. And if there is even a mild increase in unemployment, this level will likely be reached much sooner.

As we have said in our prior articles on credit cards, lower policy rates are unlikely to have a significant impact on the asset quality in the segment. Moreover, despite the 50 bps cut in September, U.S. banks are reluctant to decrease rates on credit cards. CNBC has cited a CardRatings.com survey, saying that only 37% of the credit cards surveyed changed their rates following the September cut, and the average credit card interest rate fell by just 0.13%.

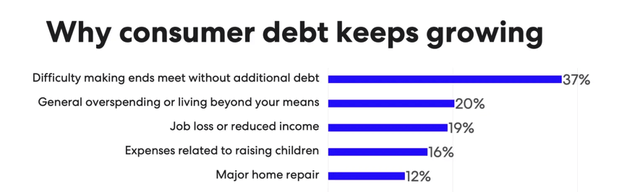

According to Forbes, the average credit card interest rate is 28.75% now. And, despite such a prohibitive rate, credit cards continue to grow at almost a double-digit rate. Credit cards are not just a tool to get points and rewards; they are a crucial debt instrument for many households. Many Americans just do not have enough money to make ends meet without using credit cards, according to a survey published by Achieve. The study says that 28% of participants reported that their debt had increased during the third quarter. Notably, 37% of people with growing debt attributed the rise to their continued inability to make ends meet.

Achieve

36% of respondents stated that they find it very difficult or difficult to make their recurrent debt payments on time, and 68% of these respondents stated that they find it difficult to make their debt payments on time because they do not earn enough money to cover their expenses. The numbers look really weak, and what is more concerning is that we are seeing this survey in an environment that is still relatively benign for a consumer.

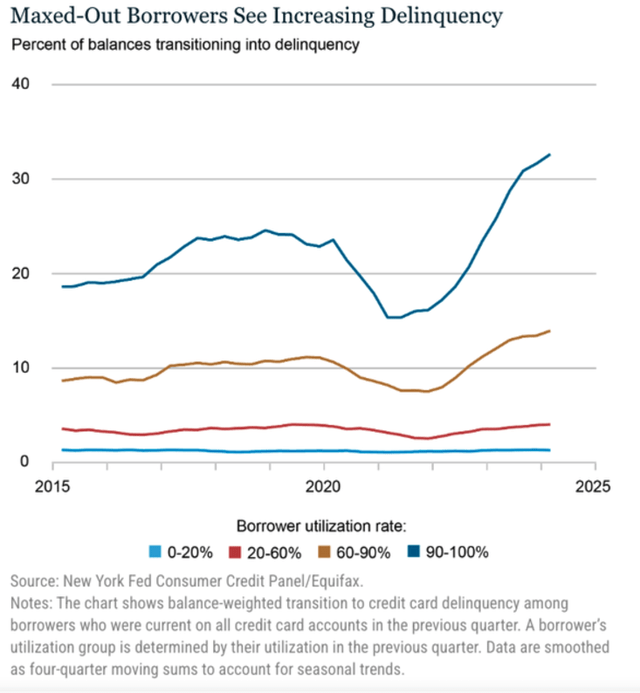

Such credit card borrowers with a tight cash flow situation and financial issues usually have a high credit card utilization rate. The Fed did not disclose separate data for these maxed-out borrowers this quarter. But in its previous report, the regulator showed that credit card borrowers with a 90-100% utilization rate have a 30%-plus transition rate.

NY Fed

Finally, it is worth reminding that the American credit card market is a very concentrated one, as almost half of total outstanding balances were granted by just three banks: JPMorgan (JPM), Citigroup (C), and Capital One (COF). Needless to say, this developing situation will have a significant impact upon these three banks.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology outlined here.