Commercial Real Estate Loans Have Only Begun To Put Pressure On Major Banks

See our latest article on bank safety, titled "Commercial Real Estate Loans Have Only Begun To Put Pressure On Major Banks."

A couple of weeks ago, there was another very concerning story about the U.S. CRE lending market. Aareal Bank, a German banking group, reported that 25% of its U.S. office loans had defaulted in the last quarter of 2023.

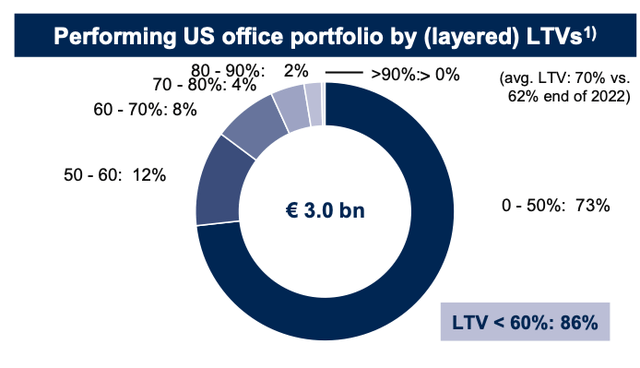

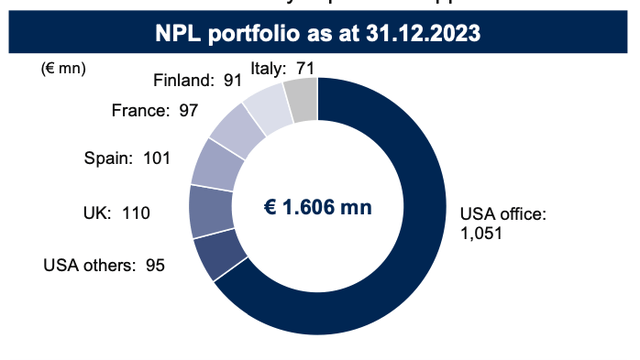

The charts below show that, as of the end of 2023, Aareal Bank had $4B of U.S. office loans, of which $1B were non-performing. Moreover, Aareal's representative said that "there is more to come" when asked about the future dynamics of bad loans in the U.S. office space.

Company Data

Company Data

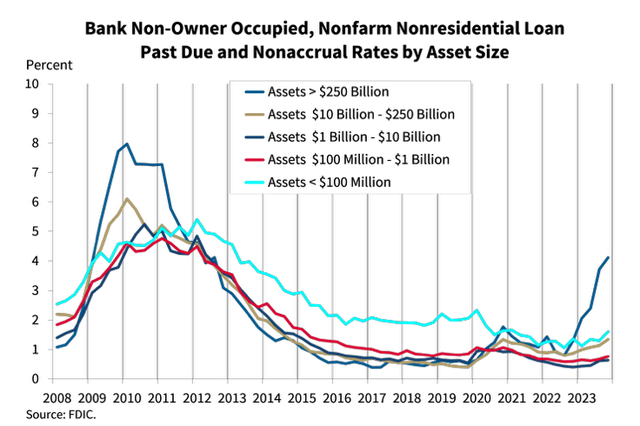

If we look at the recent FDIC report, we'll see a lower NPL ratio in the U.S. CRE segment.

FDIC

According to the FDIC:

Looking more closely at commercial real estate portfolios, there is an upward trend in past due and nonaccrual non-owner-occupied property loans, particularly at large banks. The volume of past due and nonaccrual non-owner occupied CRE loans increased by $2.3 billion, or 13.1 percent, quarter over quarter. As seen in this chart, deterioration is concentrated in the largest banks which reported a past-due-and-nonaccrual rate of 4.11 percent, well above the rate of 1.71 percent for the industry as a whole.

This trend is being driven primarily by deterioration in office loans in several major metropolitan central business districts, which tend to be serviced by large banks.

In our view, there are several important takeaways from the numbers reported by Aareal Bank and the FDIC.

First, Aareal Bank reported data on its office loans, while the FDIC showed an NPL ratio for the whole U.S. CRE lending portfolio. Hence, there's a difference as office loans are performing worse than the rest of the U.S. CRE space.

Second, in our view, given that Aareal Bank has relatively little exposure to U.S. office loans, it had the opportunity to be more conservative and recognize bad loans at one time. Obviously, if any large U.S. bank reports a 25% NPL ratio on its office portfolio, that would very likely trigger a major shock in the banking system. That suggests to us that U.S. banks will recognize bad loans in the CRE space very gradually. However, despite that, they will still incur all the losses from this lending segment.

In one of our previous articles, we cited a study published by researchers from USC, Columbia, Stanford, and Northwestern. According to the study, 14% of all CRE loans and 44% of office-related loans appear to be in "negative equity." In other words, the current values of properties, which serve as collateral for these loans, are less than the outstanding loan balances. In addition, the paper said that around one third of all CRE loans and the majority of office-related loans may encounter substantial cash flow problems and refinancing challenges. The study concluded that U.S. banks are likely to face a 20% default ratio on their CRE loans. As such, it seems that this 25% office-related NPL ratio posted by Aareal is just the beginning.

Third, the data published by the FDIC shows that the largest U.S. banks have a higher NPL ratio in the CRE space compared to the rest of the banking system. This refutes various statements made by experts and market pundits that only smaller community banks would suffer from CRE-related issues.

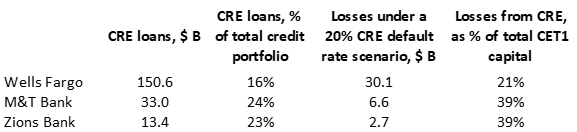

In this article, we'd like to do a short stress test. We will apply a 20% default ratio in the CRE space for Wells Fargo (WFC) (which has lately reported it had issues with the segment) and also to several super-regionals, which have relatively high exposure to CRE loans, such as M&T Bank (MTB) and Zions Banks (ZION).

Company Data

We think you can easily draw your own conclusions from the table above. Given the issues that the U.S. CRE space is facing now, WFC could lose 21% of its CET1 capital, while MTB and ZIOB could lose as much as 39% of their capital.

Bottom Line

Aareal Bank's results showed us, once again, how bad the situation is in the CRE space. Make no mistake about it, the largest U.S. banks and super-regionals also have significant exposure to CRE lending. Importantly, they have not only traditional CRE loans on their balance sheets but also loans to shadow banking intermediaries and collateralized loan obligations, which are backed by CRE credits. And it looks like the situation is going to get much worse.

I must warn you that WFC, MTB, and ZION are not alone with regard to major concerning issues sitting on the balance sheets of those banks. I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. The substance of our analysis suggests that the future is not looking too good for the larger banks in the United States, details for which can be read here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to utilize our due diligence methodology outlined here.