Commercial Real Estate Loan Risk Getting Worse By The Day

It seems that more companies are getting more honest about what's happening with U.S. CRE lending. A couple of weeks ago, we published an article on Aareal Bank, a German banking group, which reported that 25% of its U.S. office loans had defaulted in the last quarter of 2023. Needless to say, it’s rare to see a 25% NPL ratio even in a crisis environment.

Manulife (MFC), a Canadian life insurer, has recently revealed another interesting piece of data about the U.S. CRE space. The company’s CFO said that the value of its U.S. office investments had fallen by 40% from a pre-pandemic peak. This is already very close to the lowest point (47%) that was seen during the Great Recession. Moreover, almost all companies involved in the CRE business are saying that office prices have not bottomed yet.

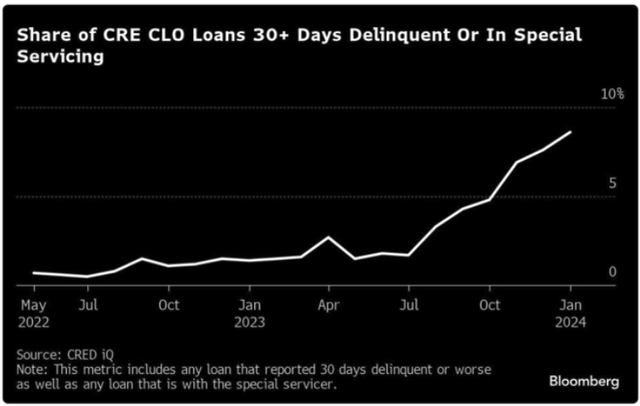

Bloomberg recently reported that about 8.6% of CRE loans bundled into CLOs (collateralized loan obligations) were 30-plus days delinquent as of January 2024. This is much higher than the respective metric of traditional CRE loans, as CLOs are one of the riskiest financial instruments.

Bloomberg

Fitch projects the U.S. CMBS office delinquency rate to more than double from 3.6% as of February 2024 to 8.1% in 2024 and 9.9% in 2025, which is even higher than the Global Recession-peak. This is quite a scary forecast, especially from credit rating agencies, which are usually very bullish and optimistic.

Yet, despite all these horrendous stats, U.S. banks are still quite optimistic about the CRE space as we did not see major increases in NPL ratios or loan loss reserves among the majority of bank in the 1Q. How could that be explained?

First, in contrast to Aareal Bank, U.S. banks will recognize bad loans in the CRE space very gradually. They simply will not re-assess all their CRE loans and post a 25% NPL ratio at once. If they did, there would likely to be a major shock in the system. However, the banks cannot postpone the recognition of bad loans forever.

Second, in order to postpone a crisis, U.S. banks are extending the maturities of CRE loans. The FT reported that Goldman Sachs estimates that $270B of commercial mortgages, which were supposed to mature in 2023, have been extended into 2024. According to US Mortgage Bankers Association data provided by Newmark, a commercial real estate advisor, $929B of CRE debt will need to be repaid or refinanced this year alone. As a result, an enormous share of loans backed by collateral that has lost about 40% of their value need to be refinanced at much higher rates. The FT also added that Newmark estimates that $670B of the loans maturing by 2026 are "potentially troubled."

Bottom line

Given all the data above, we think the CRE space is likely to trigger major shocks in the U.S. banking system soon. It's impossible for U.S. banks to extend maturities of CRE loans forever and artificially postpone a crisis in this space.

And, as a reminder, CRE is not the only issue which can lead to a major banking crisis. In our previous articles we have discussed many potential problems, such as credit cards, commercial loans, car lending, risky structured products, maturity mismatches, and other issues.

So, the best course of action for investors is to find the safest banks possible. To this end, I want to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive into the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology, which is outlined here.