Capital One: You Don't Want This In Your Wallet

Capital One: You Don't Want This In Your Wallet

By Avi Gilburt, with Renaissance Research

We have written several articles on Capital One (COF) over the past two years. Capital One is viewed by many as a bank only having one main line of business, which is credit cards. This is somewhat expected given that the bank is a Top-3 credit card lender in the U.S. However, COF also has quite a significant exposure to subprime car lending, commercial loans, and even CRE lending. In this article, we would like to take another look at COF following their release of 2Q numbers, as asset quality in almost all the bank’s lending segments has deteriorated further.

Provisions accounted for more than 50% of the credit card segment’s revenue in 2Q

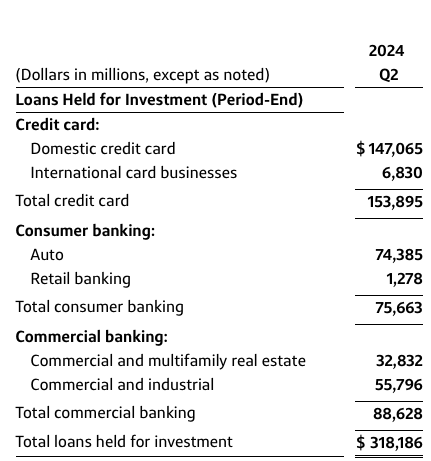

The credit card business is the largest segment of Capital One’s portfolio, as it represented 48% of the bank’s total loans as of the end of 1H24. Domestic credit cards corresponded to 96% of the segment’s outstanding loans.

Company Data

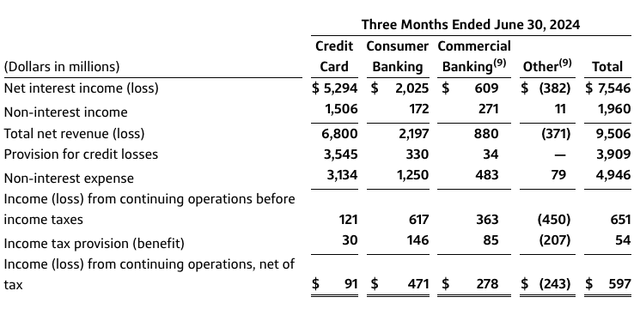

This business segment is also the largest contributor to COF’s P&L. For the second quarter, it generated 72% of the bank’s total revenue. Importantly, as the table below shows, provisions for credit losses accounted for 52% of COF’s revenue in the credit card segment.

Company Data

Source: Company data

If you follow our banking work, you are well aware of major issues in the U.S. credit card segment. Capital One has been traditionally focusing on lower-income borrowers, who are now struggling the most, as a quite significant share of credit cards granted to lower-income borrowers have a delinquency rate of more than 30%.

It is important to note that credit card-related provisions are rising despite the fact that the U.S. unemployment rate is still quite low. As such, even a mild deterioration in the labor market is likely to make this business segment of COF loss-making. This does not bode well for Capital One, given the importance of this segment for Capital One’s revenue and earnings.

Exposure to subprime car lending

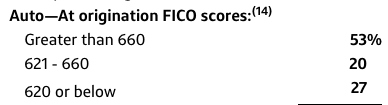

Car lending accounts for almost all loans in the segment called “Consumer Banking." In the second quarter, it generated 23% of COF’s total revenue. According to the bank, its 30-day delinquency rate on consumer banking-related loans was 6.35%, which is quite high and is above the sector average.

This should not come as a surprise, given the low FICO scores in the auto segment.

Company Data

By comparison, the median risk score of auto loan origination in the U.S. was 724 in 1Q24, according to the NY Fed. As such, this implies that a large share of COF’s car loans is subprime.

We have written a lot about major issues in the U.S. car lending segment, which were triggered by a sharp increase in car prices, especially used ones.

More than 10% of commercial banking-related loans have signs of credit quality issues

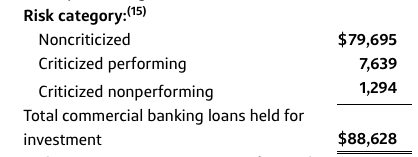

Another part of COF’s credit business is commercial lending, which is even larger than its auto book based on total outstanding loans. Commercial lending accounted for 28% of COF’s credit portfolio as of 1H24. Commercial and multifamily real estate were $33B (10% of the bank’s total outstanding loans), and commercial and industrial loans were $56B (18% of the bank’s total outstanding loans).

For its commercial banking segment, COF discloses both “criticized performing” and “criticized nonperforming” loans. COF defines criticized performing loans as “loans in which the financial condition of the obligor is stressed, affecting earnings, cash flows, or collateral values,” while criticized nonperforming loans are defined as “loans that are not adequately protected by the current net worth and paying capacity of the obligor or the collateral pledged.”

Company Data

As the table above shows, the share of problem loans in this segment is more than 10%. This is a very large share, especially for a credit card-focused bank. It is also worth noting that commercial banking-related loans account for 183% of COF’s CET1 capital. Obviously, such a high metric, coupled with a 10+% problem loan share, suggests that COF has major issues in this segment.

Bottom line

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you that Capital One is not alone regarding major concerning issues sitting on the balance sheets of those banks. The substance of our analysis suggests that the future is not looking too good for the larger banks in the United States, and you can read about it in the many public articles we have published over the last two years. And, things seem to be getting worse.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bancorp (NYCB) has reminded us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. You are welcome to use our due diligence methodology outlined here.