Canadian Banks Are Seeing Increased Risks

Our latest article on bank safety: Canadian Banks Are Seeing Increased Risks

We have already written several articles on Canadian banks. Canadian banks were among the safest in the world during the GFC, but a lot has changed since then, and we believe the Canadian banking system is very likely to face major issues.

One of the most significant problems that we have discussed is that, in contrast to the U.S., Canada has quite a large share of variable-rate mortgages, which are certainly a big headache for borrowers. The latest numbers reported by Statistics Canada, a national provider of statistical data, suggest that the situation continues to deteriorate.

For many years, the Canadian banks were very actively offering variable-rate mortgages with fixed monthly payments. Obviously, when the policy rate was near zero, this product was quite popular among their customers.

However, when the Bank of Canada started increasing policy rates, this mortgage offering created a phenomenon called “negative amortization." This is a situation when a fixed payment is not sufficient to cover both the interest portion and the principal of a mortgage. The point at which a borrower’s fixed payments become insufficient to cover all its obligations on a mortgage loan is called the trigger point. When mortgage borrowers reach their trigger point, they must renegotiate their loan terms. Most of these renegotiations result in extending repayment periods.

According to Statistics Canada, by the first half of 2023, nearly 80% of households with variable rates and fixed payments had already hit their trigger point. Given that the only viable option for the majority of borrowers is a longer repayment period, the share of mortgages with an amortization period longer than 25 years increased to more than 50%. But even if borrowers have a long amortization period, they must renew their mortgages regularly. As a result, according to the Bank of Canada, due to a longer amortization period and mortgage renewal rules, these borrowers will need to increase their payments by approximately 40% to maintain their original amortization schedule, assuming a renewal in 2025 or 2026.

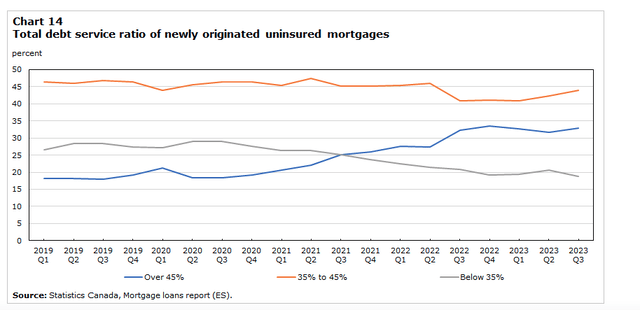

Household indebtedness levels in Canada were high even before this negative amortization issue. Needless to say, now these levels have increased even further. Moreover, even borrowers with newly originated mortgages have difficulties in repaying them. Statistics Canada provides data on the total debt service ratio (TDSR), which is calculated as all loan obligations as a ratio of disposable income. As the chart below shows, there was a significant increase in the share of borrowers with a TDSR of more than 45%.

Statistics Canada

The Canadian government has recently introduced new mortgage rules, which include expanding eligibility for 30-year mortgage amortizations to all first-time homebuyers and to all buyers of new builds. Notably, even the Bank of Canada raised concerns about these longer amortization periods. Carolyn Rodgers, the Bank of Canada’s deputy governor, said that such measures could have long-term negative impacts for financial stability.

“Longer amortizations and smaller down payments, however, increase risk for lenders and borrowers,” Rogers told the Economic Club of Canada in Toronto on Wednesday, according to her prepared remarks.

She gave the example of a borrower who increases their amortization from 25 years to 30 years, shaving $200 off their monthly payments but adding an additional $50,000 in interest costs over the lifetime of their mortgage.

If you follow our work on U.S. banks, you know that we have published several articles on the U.S. CRE market and the so-called “extend-and-pretend” behavior of U.S. banks. Basically, instead of recording losses from non-performing CRE loans, U.S. banks just extend the maturities of these loans. We find some similarities between this practice of U.S. banks in the CRE market and what Canadian banks are doing with residential mortgage loans. There will likely be major negative implications for both banking systems due to these quite similar practices.

Bottom line

We expected that Canadian banks that have variable-rate mortgages would have major issues, and, as such, we have done a lot of research to find banks in Canada that would be more resilient to this issue. We found only two banks that meet our criteria. Those two banks are the best we could find in Canada, and they are the best choice for those Canadians who want to keep their money in their country. But those who have the opportunity to open an account at a U.S. or European bank should take a look at our top U.S. banks to diversify their savings. But, please note that the Big Six banks in Canada did not meet our standards.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to utilize our due diligence methodology, which is outlined here.