Black Box Concerns That Can Collapse Major Banks

See our latest article on bank safety, titled "Black Box Concerns That Can Collapse Major Banks."

We have been warning our readers of various issues in the U.S. banking sector for almost two years. Some of them, such as maturity mismatch risks and CRE lending, already have led to very negative consequences for the system. We have also discussed problems with credit cards, auto loans, commercial lending, and non-U.S. loans. There also are many issues with liquidity, securities books, derivatives, and off-balance sheet exposure, which we have outlined as well.

In this article, we would like to highlight a lending segment that looks like a major concern for the largest U.S. banks. Importantly, this issue is being discussed rarely because it is a black box for analysts, investors, and depositors. We're talking about so-called shadow banking loans.

Last week, the Fed reported that loans to nondepository financial institutions surpassed the $1T mark as of the end of January. These nondepository financial institutions include shadow banking intermediaries, which mostly consist of hedge funds, private equity firms, venture capital funds, real estate investment trusts, and various financial companies. These shadow banking intermediaries are regulated and supervised quite lightly, especially compared with banks. As a result, loans that the U.S. banking system is granting to shadow lenders are extremely risky.

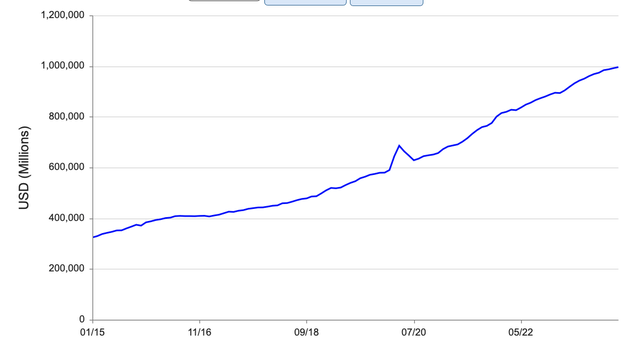

Loans to shadow banking companies have shown impressive growth over the past decade. As the chart below shows, these loans skyrocketed by more than 200%, from $324B as of January 2015 to more than $1T as of January 2024. In other words, those loans now account for almost half of the sector’s total equity.

Loans to nondepository financial institutions

The Fed

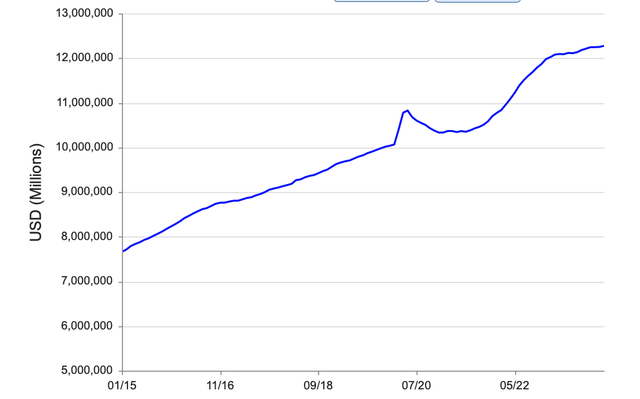

By comparison, total loans and leases in bank credit have increased by less than 60% over the same time period.

Total loans and leases in bank credit

The Fed

The biggest concern is that shadow banking loans have been regulated very lightly, as usually these loans finance very complex deals and transactions, including leveraged buyouts or startup-related financing. As such, these loans are a black box not only to the public but to regulators as well.

Acting head of the Office of the Comptroller of the Currency, Michael Hsu, recently told the Financial Times when asked about shadow banking lenders that “he thought the lightly regulated lenders were pushing banks into lower-quality and higher-risk loans”:

"We need to solve the race to the bottom,” said Hsu. “And I think part of the way to solve it is to put due attention on those non-banks.”

In other words, the head of the OCC, one of the largest U.S. banking regulators, is saying that U.S. banks have $1T of lower-quality and higher-risk loans on their balance sheets, as these loans were granted to shadow banking lenders.

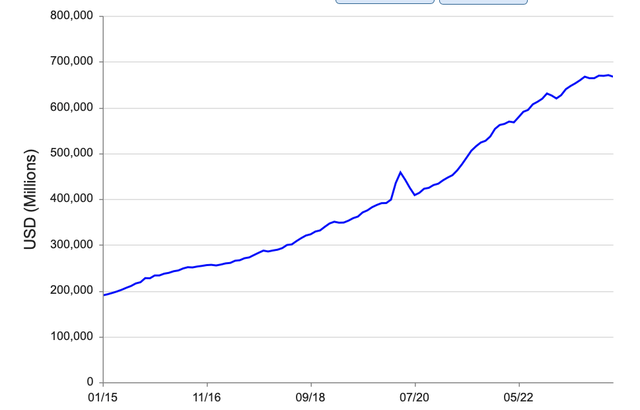

It should be pretty obvious that mostly the largest U.S. banks are working with shadow lenders due to complexity of these transactions. As the chart below shows, the Fed data confirms this issue. Almost 70% of these loans to shadow banking intermediaries were granted by 25 U.S. largest banks.

Loans to nondepository financial institutions – Top 25 U.S. banks

The Fed

Bottom Line

If you still think that the largest banks will be the safest in a systemic crisis scenario, despite all our previous articles, here's another issue of which you must be aware. There are $1T of lower-quality and higher-risk loans sitting on U.S. banks’ balance sheets, of which almost 70% were granted by Top-25 U.S. banks.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Our due diligence methodology here.