Big Issues At Big Banks Are Hiding Right In Front Of Your Face

Big Issues At Big Banks Are Hiding Right In Front Of Your Face

By Avi Gilburt, with Renaissance Research

The recent sell-off in the markets and increasing odds of a recession in the U.S. resumed talks about the resilience of the largest U.S. banks to a major financial crisis.

If you're following mainstream financial media, then you have probably noticed that almost all pundits are constantly repeating the popular narrative that “the largest U.S. banks are well capitalized now, and a repeat of the 2008 crisis is extremely unlikely." Most experts provide quite a shallow analysis to support these propositions and just look at headline capital ratios without analyzing the banks’ financial positions.

If you're familiar with our banking work, then you're aware of multiple major issues sitting on the U.S. banks’ balance sheets. You can read about them in the prior articles we have written.

In this article, we would like to show that even if we ignore all those issues, the narrative that “the largest U.S. banks are well-capitalized and are prepared for financial shock” is still wrong.

We have already written about the collapse of Archegos Capital and its impact on global banks. As a reminder, the banks posted almost $10B in losses from the default of Archegos Capital, but Credit Suisse suffered the most, as the bank recorded $5.5B in losses on a notional exposure of more than $20B. At the time, Credit Suisse’s tangible equity was CHF38B. In other words, its exposure to Archegos Capital was more than half of its equity. The default of Archegos Capital was one of the key reasons for Credit Suisse’s collapse and its acquisition by UBS.

This case alone says a lot about capital positions and risk management at the largest global banks. The fact that a notional exposure to just one hedge fund was more than half of Credit Suisse’s equity should have been a wake-up call for many. More than 12 years have passed since the Great Recession, and it was a consensus view that such a failure in risk management would never happen again. Alas, most have not learned their lesson.

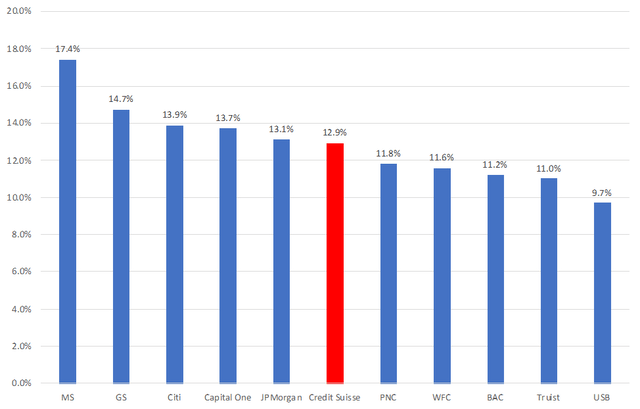

Let’s compare Credit Suisse’s CET1 ratio with the respective metrics of the largest U.S. domestic banks. For starters, this indicator is calculated by dividing a bank’s CET1 (Common Equity Tier 1) capital by its total RWA (risk-weighted assets). For further information, according to the Basel standards, CET1 capital is the highest quality of regulatory capital as it absorbs losses immediately when they occur. Basically, the CET1 capital shows a bank's ability to weather a financial crisis and maintain its solvency. There are some differences between the calculation methodologies of the Fed and the ECB, but still, the CET1 ratios of the U.S. and European banks are quite comparable. We will use YE2020 figures, as the Archegos collapse happened in 2021.

CET1 ratios (standardized approach), YE2020

Company Data

As the chart above shows, the headline CET1 ratio suggested that Credit Suisse was well capitalized, even compared to some of the U.S. banks. Of course, at the time, publicly available data did not show that Credit Suisse’s exposure to just one hedge fund was more than half of its CET1 capital. As such, one can only wonder how much any of the largest U.S. banks are exposed to one counterparty now.

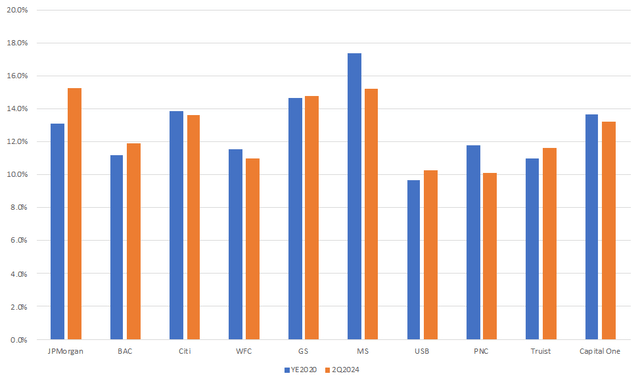

Notably, only some of the largest U.S. banks have improved their CET1 ratios since 2020. The chart below compares the metrics of YE2020 and 2Q2024.

CET1 ratios (standardized approach)

Company Data

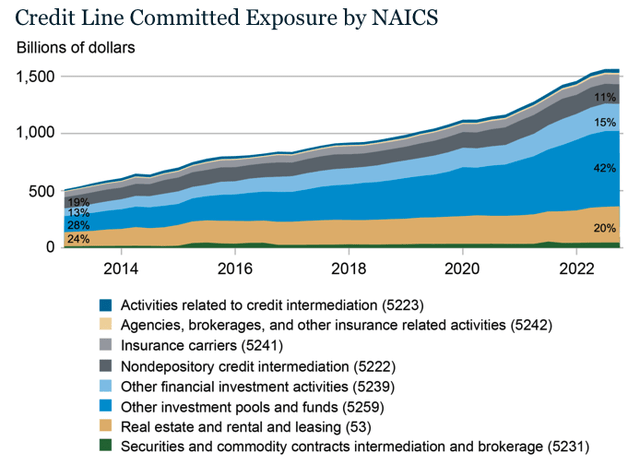

In our previous article, we discussed shadow lenders, which also include hedge funds. According to the Fed, loans to shadow lenders granted by U.S. banks reached $1.15T as of the end of June. Almost 70% of these loans to shadow banking intermediaries were granted by the 25 U.S. largest banks. Importantly, these numbers show only the balance sheet exposure of U.S. banks to shadow lenders. The NY Fed has recently provided data that looks beyond the balance sheets and analyzes contingent liabilities. As the chart below shows, these liabilities are greater than $1.5T, i.e., even higher than balance sheet exposures.

NY Fed

Another interesting thing is that when the Fed announced its plans to slightly increase capital requirements for the largest banks, the powerful banking lobby launched an unprecedented campaign against these changes. We published a detailed article about this. It looks like the efforts of the banking lobby were successful. The obvious question here is: Why have large banks launched such a fierce lobbying campaign? At the end of the day, CEOs of large banks are constantly saying that their banks are well capitalized, and a well-capitalized bank should easily meet those mild increases in capital requirements. Clearly, something seems quite askew.

Bottom line

In this difficult environment, you should take most stories from the financial media, analytical reports, or even articles by independent analysts with a very large grain of salt. A lot of the conclusions from these reports are incorrect and not supported by the public data.

Believe it or not, there are more major issues on larger bank balance sheets relative to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks, including those noted above, in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written. And, as these issues get worse, the risk continues to rise.

Moreover, if you believe that the banking issues have been addressed, I think that more recent issues surrounding New York Community Bancorp (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, one of the main reasons being the banking industry's desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive into the banks that house your hard-earned money to determine whether your bank is truly solid or not. You are welcome to use our due diligence methodology outlined here.