Big Banks Have Massive Exposure: TD Bank Has Several Major Issues

As part of our ongoing series of articles on bank stability, and at the request of many of our clients at Safer Banking Research, we wanted to address TD Bank (NYSE:TD) in this missive.

I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But, I must warn you. The substance of that analysis is not looking too good for the future of the larger banks in the United States. You can read about them here.

In our previous article on Canadian banks, we mentioned that there's a lot of misunderstanding regarding the Canadian mortgage system. In particular, many clients of Canadian banks view the mortgage insurance system in the country as a safety feature that would protect banks from the negative consequences of a potential real estate bubble. However, this system is mandatory only for mortgages with a down payment of less than 20%.

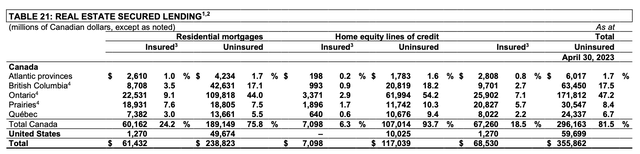

As the table below shows, only 24% of TD’s mortgages are insured, and only 6% of the group’s home equity lines of credit (HELOC) are insured. If we add mortgages and HELOC loans, then only 18.5% of TD’s real estate-secured loan book is insured.

Company Data

Canadian real estate prices had an impressive run during the COVID pandemic and peaked at the beginning of 2022. However, since then, there have been quite sharp declines, especially in some provinces. If we look at Ontario, it's by far the largest province for TD in terms of lending, as almost 55% of TD’s personal real estate loans were granted there, which should not come as a surprise given that Toronto, the most populated Canadian metropolitan area, is located in Ontario.

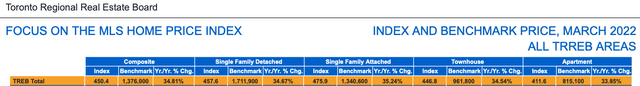

As the table below shows, according to the MLS Home Price Index, Total Toronto Regional Real Estate peaked in March 2022 if we look at the TREB Total Composite Benchmark. Since then, this benchmark has fallen by almost 17%.

TRREB - Home

TREBB - Home

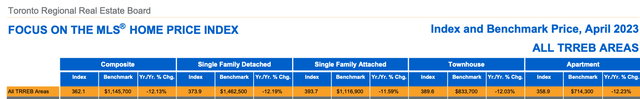

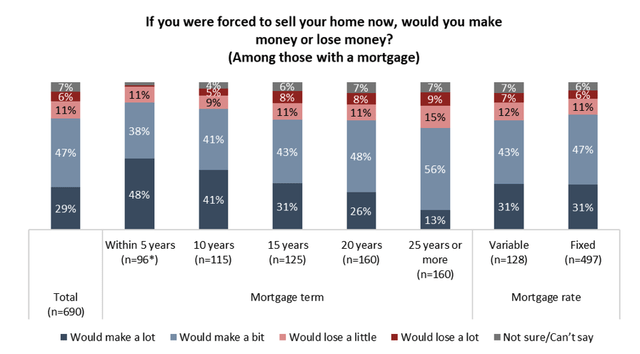

Unsurprisingly, according to a survey conducted by The Angus Reid Institute, 24% of those with long-term mortgages (i.e., those borrowers who recently took a loan) are most likely to say they would lose money if they were forced to sell their property.

The Angus Reid Institute

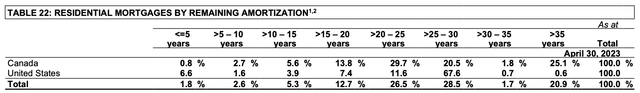

If we look more closely at TD, 20.5% of its residential mortgages in Canada have a remaining amortization of 25-30 years. By comparison, the Canadian bank that we have recently recommended to our subscribers at SaferBankingResearch.com has a respective share of less than 9%.

Company Data

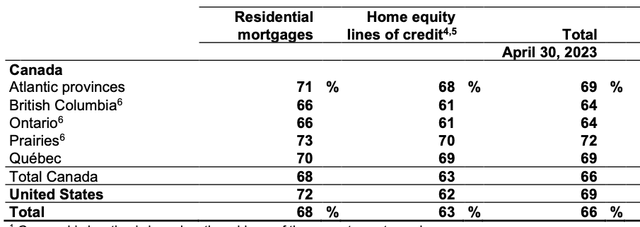

TD’s LTV ratios also have increased. The average LTV of outstanding uninsured mortgages grew from 48% in 2Q22 to 53% in 2Q23. The average LTV on newly originated residential mortgages reached 66% in Ontario and 72% in Canada overall, according to the table below.

Company Data

Another issue is that TD has quite a large share of variable-rate mortgages, which are certainly a big headache for borrowers in the current rising rate environment in Canada. According to the latest data, 43% of TD’s real estate-secured lending has a variable interest rate. By comparison, the Canadian bank that we have recently recommended to our subscribers at SaferBankingResearch.com has a share of variable-rate mortgages of less than 30%.

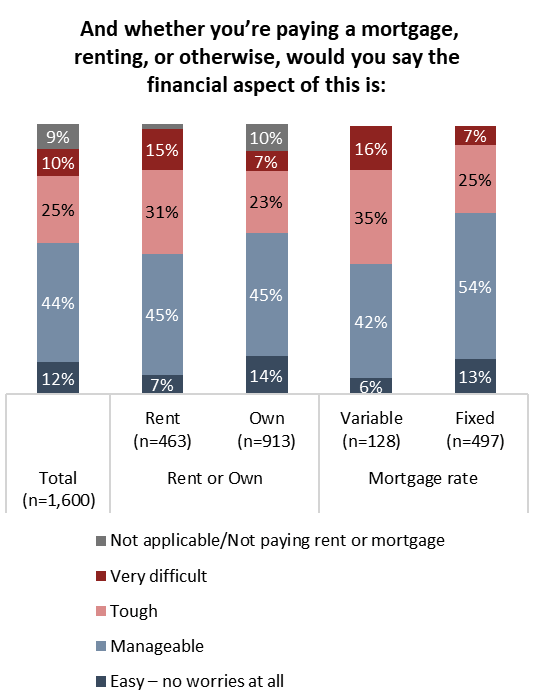

According to The Angus Reid Institute survey that we already have mentioned, 51% of Canadians who have a variable-rate mortgage are having a tough or difficult time with their mortgage. For those who have a fixed-rate mortgage, this figure goes down to 32%.

The Angus Reid Institute

Another interesting finding from this survey is that half of those Canadians with a variable rate mortgage said they had recently taken money out of a savings account that they try not to touch.

Without a doubt, all of the above does not look good for TD’s Canadian mortgage business.

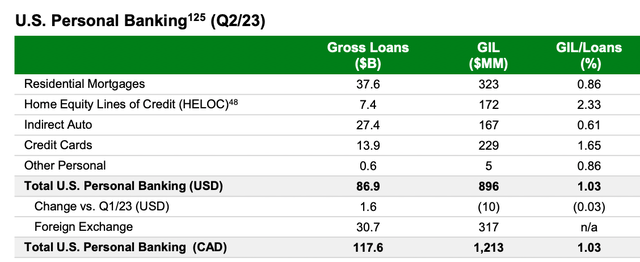

U.S. Retail Business: A large share of credit cards and auto loans in the bank’s U.S. book

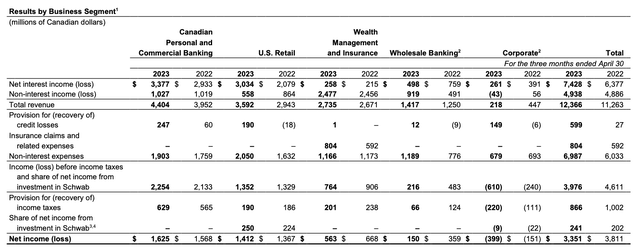

As shown below, TD’s U.S. Retail Business is a very significant contributor to both revenue and earnings of the group.

Company Data

The loan mix in U.S. personal banking is quite different from Canada's. Indirect auto and credit cards accounted for 48% of the total portfolio as of 2Q23. We have written a lot about potential major issues in the credit card segment and vehicle lending in our previous articles, and TD is unlikely to avoid them should a systemic crisis come. We also note relatively high shares of GILs (gross impaired loans) in TD’s HELOC and credit cards, which may indicate TD has already seen the first signs of credit quality deterioration in its U.S. retail lending book.

Company Data

Corporate business: Significant exposure outside Canada and the U.S., as well as to volatile industries

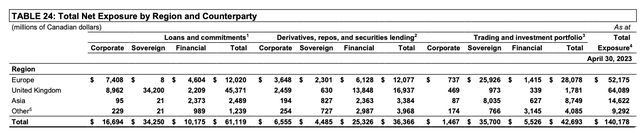

It may come as a surprise for some, but TD has significant exposures outside Canada and the U.S. The table below shows a breakdown of these exposures.

Company Data

We assume almost all non-Canadian and non-U.S. exposures are associated with TD’s commercial business segment. This segment’s total loan book was CAD 312B as of 2Q23, which suggests that total net non-Canadian and non-U.S. exposures, including loans, derivatives, and trading portfolios, account for 45% of all TD’s business loans, which is a quite high share in our view.

As we said in our previous articles, we view non-domestic exposure as a major risk for banks for several reasons.

Another thing that caught our eye is that almost 20% of TD’s commercial loans were granted to companies in such volatile industries as financials, oil and gas, and metals and mining.

TD has reportedly serious AML-related issues

In February 2022, TD announced plans to acquire First Horizon (FHN). However, in May 2023, the group unexpectedly issued a press release saying that "the parties mutually agreed to terminate the merger agreement because there is uncertainty as to when and if these regulatory approvals can be obtained."

Several days later, the Wall Street Journal published a report saying that regulators refused to approve the deal due to TD’s reported handling of "suspicious" customer transactions. According to the report, the anti-money laundering (AML) practices of TD apparently were the main obstacle for the regulator, and TD’s promises to make its AML procedures more thorough did not convince the regulators.

We believe retail depositors should be very cautious with banks that have major AML issues, as those could lead to enormous fines or even worse outcomes, especially if a systemic crisis comes.

Bottom Line

Toronto-Dominion Bank was among the safest in the world during the 2008-2009 crisis. But a lot has changed since then. We believe the Canadian banking system is likely to face significant issues if a major recession comes.

At SaferBankingResearch.com, we found only two Canadian banks that meet our criteria. Those two banks are the best we could find in Canada, and they are the best choice for those Canadians who want to keep their money in their country. But those who have the opportunity to open an account at a U.S. or European bank should take a look at our Top US Banks to diversify their savings.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money. You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. And you can utilize the methodology we outline here.