Big Banks Have Massive Exposure: Canadian Banks Have A Major Issue Developing.

As part of our ongoing series of articles on bank stability, and at the request of many of our clients, we wanted to address the major risks we foresee for bank stability in the coming years.

But before we begin, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I'm sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It's now only a matter of time.

So, let's move onto the next issue we are seeing in Canadian banks.

We already have written several articles on Canadian banks. Canadian banks were among the safest in the world during the 2008–2009 crisis, but a lot has changed since then, and we believe the Canadian banking system is very likely to face major issues. One of the most significant problems that we have discussed is that, in contrast to the U.S., Canada has quite a large share of variable-rate mortgages, which are certainly a big headache for borrowers in the current rising rate environment. The latest numbers reported by the Canadian banks suggest that the situation continues to deteriorate.

The so-called “negative amortization” is a major concern for the stability of the Canadian banking system

In our previous articles, we noted that a higher-for-longer interest rate environment and a significant share of variable-rate mortgages are a very concerning combination. The recent results suggest that the Canadian banking system is expected to struggle with this mix. Canadian banks were very actively offering variable-rate mortgages that have fixed monthly payments when interest rates were near zero, and, for obvious reasons, this product was quite popular among their customers.

However, when the Bank of Canada started increasing policy rates, this mortgage offering created a phenomenon called “negative amortization." This is a situation when a fixed payment is not sufficient to cover both the interest portion and the principal of a mortgage. This point at which a borrower’s fixed payments become insufficient to cover all its obligations on a mortgage loan is called the trigger point.

Currently, Canadian banks offer the following solutions for those clients who hit their trigger points: 1) Switching to fixed-term mortgage products; 2) making a lump-sum payment; or 3) extending repayment periods. Obviously, not many borrowers can choose the first two options, and, as a result, the banks are extending repayment periods. Moreover, some borrowers are not even able to cover interest payments on their mortgages. The remaining part of the interest, which is not repaid, is being added to the principal. In other words, loan amounts are ballooning.

In its latest earnings release, Toronto-Dominion Bank (TD) disclosed that "CAD 45.7B, or 18% of the mortgage portfolio in Canada, relates to mortgages in which the fixed contractual payments are no longer sufficient to cover the interest."

According to BMO Bank (BMO), "as a result of increases in interest rates, the portfolio included CAD 32.8B of variable-rate mortgages in negative amortization, where all of the contractual payment is currently being applied to interest and the portion of the interest requirement not met by the payment is being added to the principal." This accounts for 19% of BMO’s outstanding mortgage loans.

CIBC (CM) disclosed that "CAD 49.8B relates to mortgages in which all of the fixed contractual payments are currently being applied to interest based on the rates in effect at July 31, 2023, and the terms of the mortgages, with the portion of the contractual interest requirement not met by the payments being added to the principal." This accounts for 18% of CIBC’s total mortgage portfolio.

Canadian mortgage borrowers are struggling to make payments, while the country’s economy contracted in Q2

In our previous article on TD Bank, we discussed a survey published by the Angus Reid Institute. According to the survey, 51% of Canadians who have a variable-rate mortgage are having a tough or difficult time with their mortgage. In addition, half of those Canadians with a variable-rate mortgage said they had recently taken money out of a savings account that they try not to touch. Finally, 24% of those with long-term mortgages (i.e., those borrowers who recently took a loan) are most likely to say they would lose money if they were forced to sell their property.

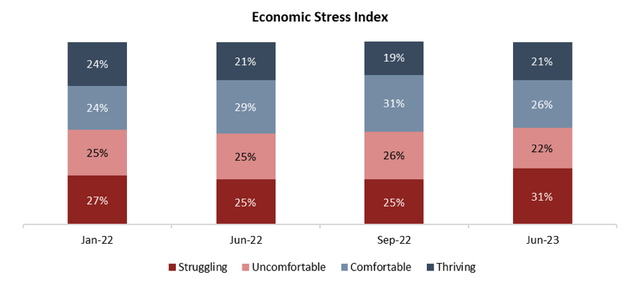

According to the Angus Reid Institute, since September 2023, there has been a 6 ppt increase in the proportion of Canadians who fall into the “Struggling” category based on their financial conditions.

Angus Reid Institute

As a result of lower growth in household spending caused by higher interest rates, the Canadian economy contracted by 0.2% YoY in 2Q23. Meanwhile, Canada's annual inflation rate in August grew to 4.0% from 3.3% in July, and, as a result, many economists expect another rate hike from the Bank of Canada, which will have a further negative impact on variable-rate mortgages in the country.

Bottom line

We expected that Canadian banks that have variable-rate mortgages would have major issues, and, as such, we have done a lot of research to find banks in Canada that would be more resilient to this issue. As noted earlier in the article, around 20% of larger Canadian banks’ mortgages have already fallen into this "negative amortization." However, the bank that we have recommended has a much more conservative lending policy. Thanks to that, less than 6% of its mortgage book is in the negative amortization zone.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you're relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to utilize our due diligence methodology, which is outlined here.