Big Banks Have Massive Exposure: A Look At Canadian Banks

As part of our ongoing series of articles on bank stability, we wanted to address Canadian banks in this missive. I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But, I must warn you. The substance of that analysis is not looking too good for the future of the larger banks in the United States. You can read about them here.

So, let's take a look at the Canadian banking environment. Canada did not have a banking crisis in 2008. In fact, during the Great Recession, Canadian banks, especially the so-called Big Six, were among the safest banks in the world. However, their business models have changed significantly since then. Yet, many retail depositors in both Canada and the U.S. still think that Canadian banks would be a safe haven in a major global crisis. In this article, we would like to highlight some of the issues we currently see at Canadian banks.

Exposure to capital markets and wealth management-related revenues have increased substantially

The revenue mix of Canadian banks has changed a lot since the Great Recession. If we look at Royal Bank of Canada (RY) aka RBC, which is the largest Canadian bank and is also viewed by many depositors as the safest bank in Canada, then its share of revenues from capital markets and wealth management increased from 37% in 2007 to 53% in 2022. Obviously, these revenues are very volatile and are very likely to be under significant pressure in a recessionary environment.

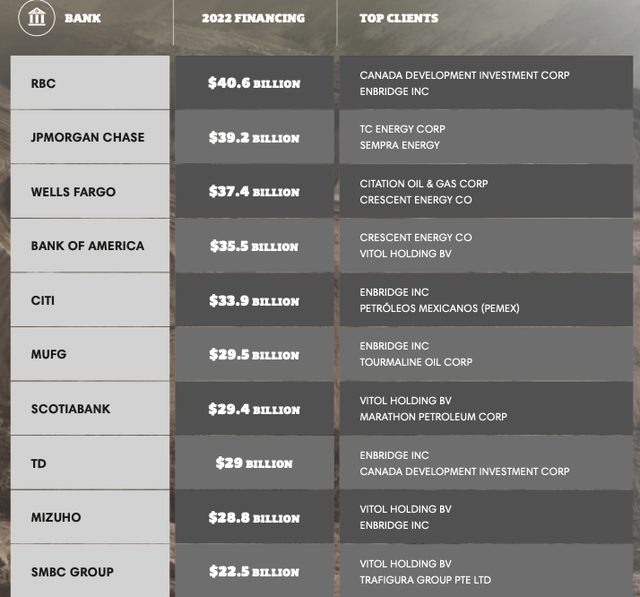

Rising financing for oil and gas and mining companies

According to the 2023 Fossil Fuel Finance Report, for the first time since 2019, when this report was published, RBC ranks #1 as the largest financier of fossil fuels. RBC provided fossil fuel companies $42.1B in 2022, an increase over its 2021 financing, making for a total of $253B since 2016. Notably, JPMorgan Chase (JPM) was ranked second with $39 billion; however, JPM’s total assets are $3.7 trillion, and RBC’s total assets are less than $1.5 trillion. The Bank of Nova Scotia (BNS) aka Scotiabank and The Toronto-Dominion Bank (TD), which are among the Big Six Canadian banks, are also on this list.

2023 Fossil Fuel Finance Report

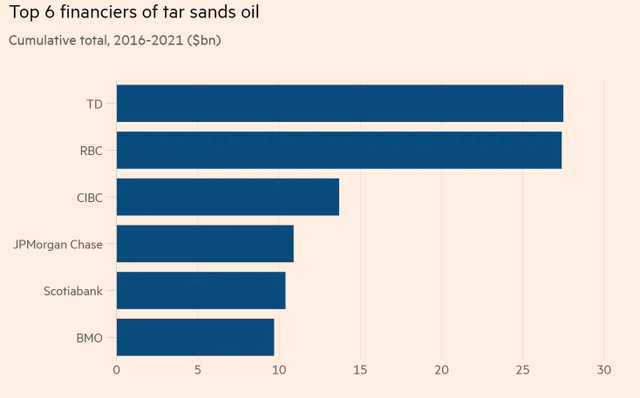

In addition, five of the six largest global financiers of the tar sands are Canadian banks.

RAN, Financial Times

Source: RAN, Financial Times.

The tar sands oil industry has already faced major issues during the 2014–2016 oil crisis. Obviously, these energy loans would be under severe pressure in a recessionary environment.

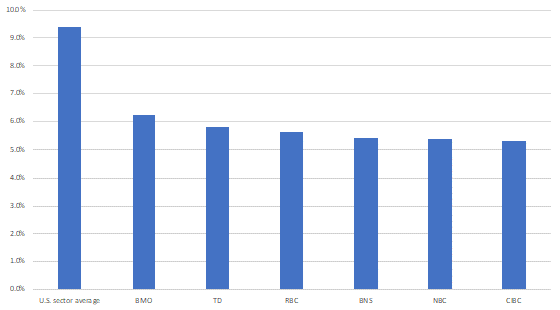

The leverage ratio is a concern

According to our estimates, the weighted-average leverage ratio of the Big Six Canadian banks was a tad above 5.5% as of the end of 2022. By comparison, the respective metric for the U.S. banks was more than 9%. We believe Canadian banks have low leverage ratios given that their business models have become more risky since 2008.

Company Data

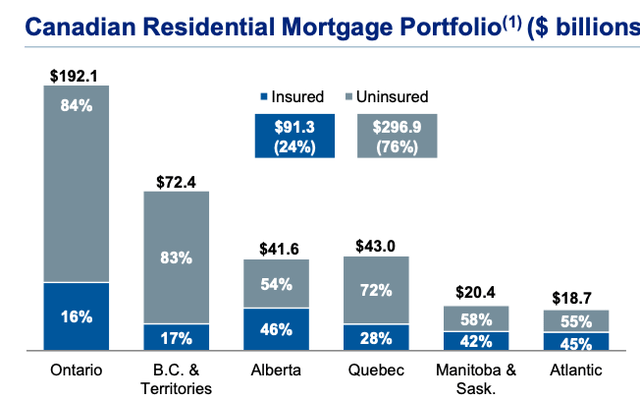

Residential mortgages and high real estate prices In Canada

Many clients of Canadian banks view a mortgage insurance system in the country as a safety feature that would protect banks from the negative consequences of a potential real estate bubble. However, this system is mandatory only for mortgages with a down payment of less than 20%. If we look at RBC's mortgage book, 76% of its mortgage book is uninsured. More importantly, the highest shares of uninsured mortgages are in Ontario (83%), followed by British Columbia (82%), which saw the highest increases in real estate prices.

Company Data

The Bottom Line

The Canadian banks were among the safest in the world during the 2008–2009 crisis, but their business models have changed significantly since then. There are 34 domestic banks in Canada, and it’s a quite small and oligopolistic market. At SaferBankingResearch.com, we found only two banks that meet our criteria. Those two banks are the best we could find in Canada, and they are the best choice for those Canadians who want to keep their money in their country. But those who have the opportunity to open an account at a U.S. or European bank should take a look at our Top banks to diversify their savings. The Big Six did not meet our standards.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money. You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And, if you are relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It is time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. And, you can feel free to utilize the methodology we outline here.