Bankruptcies And Credit Card Defaults Spell Big Trouble For Banks In 2025

New article by our team: Bankruptcies And Credit Card Defaults Spell Big Trouble For Banks In 2025

Before we move into the relevant banking issues we currently see, I want to make sure everyone is clear about the purpose for which we're writing these missives. Some of you seem to believe that we are claiming that banks are about to go under imminently. That's not the purpose for which these are articles are written.

We see the risks on bank balance sheets as potentially even exceeding those that were present before and ultimately led to the Great Financial crisis of 2007-2009. But these risks will only begin to become evident to the public once the stock market moves into the bear market we expect will become quite oppressive and exert stress upon our banking system. But, by then, it may be too late for many of you.

Therefore, we're writing these articles now when there's ample time for you to do the appropriate due diligence on the banks that house your hard-earned money. And, if need be, there's time and opportunity to move your money to stronger banks that may survive the next banking crisis, which clearly seems to be on the horizon.

So, now let's move into the latest concerning issues we see in the banking industry.

Back in 2023, almost all mainstream media and analysts from large investment banks were saying that issues in the credit card segment are temporary as charge-offs and delinquency ratios are “just normalizing” following the pandemic lows. If you follow our banking work, you know that we had a different view due to the several reasons we had outlined in our previous articles. We were still very much believe that banks are very likely to face significant problems in the credit card segment.

The recent data showed even further deterioration in the credit card space, which strongly indicates that this is not temporary. According to the latest report on household debt, which was published by the NY Fed, the share of delinquent credit cards has reached the highest level since 2012. This share is now just around 300 bps below the peak, which was seen during the Great Recession.

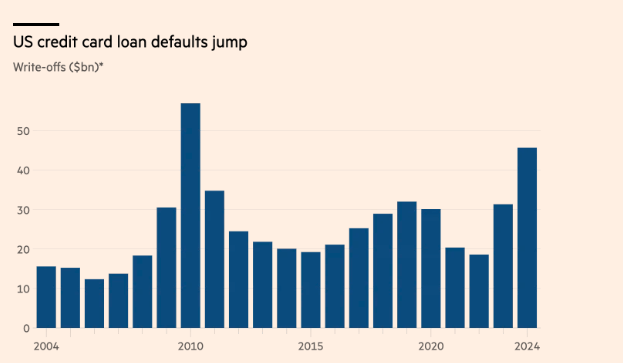

Another important indicator also suggests that the segment is facing major issues. As the chart below shows, defaults on credit cards have reached the highest level in 14 years.

Financial Times

Notably, we are seeing these concerning numbers under an environment of a still-growing economy and relatively low unemployment levels. Obviously, even a mild worsening in the job market will very likely lead to much worse figures.

Again, if you read our prior banking articles, you are aware of the reasons for this major deterioration in the credit card industry.

Various surveys and studies show that a lot of consumers simply do not have enough money to make ends meet without using credit cards. According to a survey published by Achieve, 28% of respondents reported that their debt had increased during the third quarter. Notably, 37% of people with growing debt attributed the rise to their continued inability to make ends meet. According to another study, published by PYMNTS, the share of consumers carrying at least some card debt was 75% in November. However, the percentage is more than 90% for consumers who live paycheck to paycheck with issues paying bills.

Such surveys suggest that credit card defaults in 2025 is likely to surpass a 14-year peak, which was recorded in 2024.

It is worth reminding that the American credit card market is a very concentrated one, as almost half of total outstanding balances were granted by just three banks: JPMorgan (JPM), Citigroup (C), and Capital One (COF).

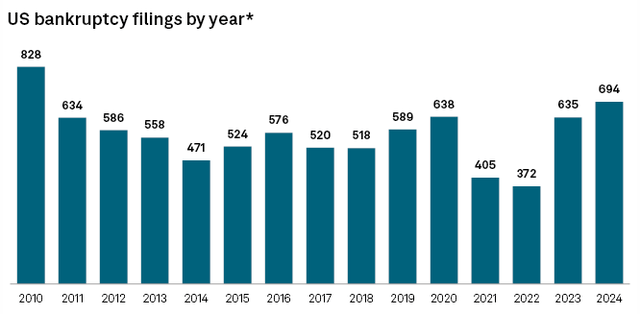

Importantly, the credit card industry is not the only lending segment that is experiencing a sharp rise in defaults. According to a report by S&P, US corporate bankruptcy filings have also hit a 14-year high in 2024.

S&P Global

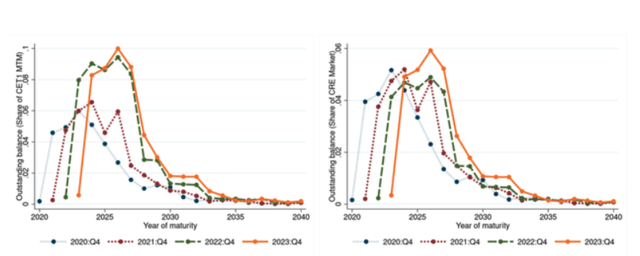

We have also discussed issues in the CRE lending and commercial & industrial credit in our previous articles. Notably, the level of bankruptcies has reached a 14-year peak despite the banks’ sluggishness in recognizing bad loans, which is often called the extend-and-pretend behavior. This pattern led to an ever-expanding “maturity wall," namely an increasing volume of CRE loans set to mature in 2025-2027.

NY Fed

As such, similar to credit card defaults, this year, corporate bankruptcies are also likely to surpass a 14-year peak, which was seen last year. Needless to say, these trends will have a significant impact upon the banking industry.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets.

These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to review and utilize our due diligence methodology here.