Banking Regulators Continue To Water Down Protections For The Public

Latest article on bank safety by Avi Gilburt and Renaissance Research: Banking Regulators Continue To Water Down Protections For The Public

We have recently published an article about the recent changes in the Basel III endgame rules, which were announced by the Fed vice chair for supervision, Michael Barr. According to Mr. Barr, the Fed will increase capital requirements for the largest U.S. banks by 9%. As a reminder, the initial plan was to increase the requirements by 19%, which was later cut to 16%, and ultimately taken down to 9%.

As we have said previously, in truth, even a 19% raise would have been a mild increase, as the current state of the credit cycle in the U.S. Credit quality metrics of most lending products in the system are deteriorating quite rapidly, while exposure of large banks to shadow banking intermediaries and extremely risky structured products has grown by double-digit rates. Yet, for some reason, the Fed and other regulators have decided to significantly reduce planned increases in capital requirements.

It is also worth noting that the new proposals are even weaker than those that were approved by the Basel Committee on Banking Supervision on a global level. In other words, large U.S. banks will have weaker capital requirements compared to their global peers. For example, Michael Barr said the following:

Second, I plan to recommend to the Board that we calculate fee income on a net basis in calculating its contribution to the operational risk capital requirement. The original proposal would have measured the contribution of fee-based activities based on gross revenues instead of net income, which is revenues minus expenses.

According to the Basel Committee on Banking Supervision, gross fee revenue is still being used for a calculation of operational risk requirements. The proposal announced by the Fed vice chair for supervision will give investment banks a lot room to engage in accounting games to lower their operational risk requirements as they are able to reclassify some parts of trading losses into fee expenses.

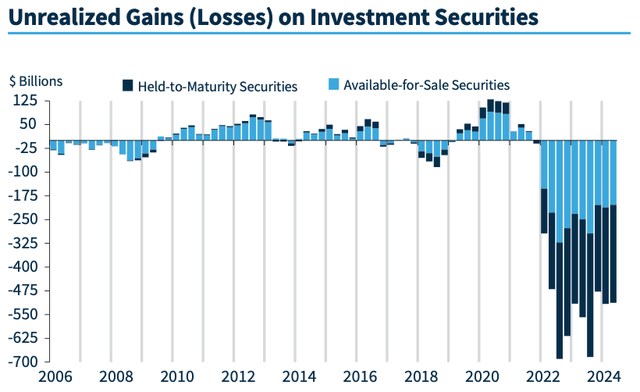

Another thing worth mentioning is that the new proposals will not solve the issue with unrealized losses on HTM securities, which, as shown below, account for more than half of U.S. banks’ unrealized losses on securities.

FDIC

The mainstream media said that the proposals announced by Mr. Barr are a huge win for the largest U.S. banks. Yet, given the latest news, it looks like even these major concessions are not enough for bank lobby groups.

The website “Americans Can’t Afford It” has recently published a press release, saying that:

The Forum has conducted an extensive, data-based assessment of the proposal and

found that capital requirements for the U.S. GSIBs would vastly exceed government estimates.

Inclusive of expected changes to the GSIB surcharge, the proposal would increase capital requirements for U.S. GSIBs by 30%. ….

Given the significant analytical gaps in the proposal and the unjustified decision to impose higher requirements than the international standard or the treatment of competitor banks by other jurisdictions, the agencies must repropose the rule in full, providing a comprehensive analysis justifying any proposed increase in requirements, and provide the public with 120 days to comment on the new proposal.

Importantly, the website did not provide any estimates or calculations. And, interestingly, “Americans Can’t Afford It” was founded by the Financial Services Forum, which, according to its website, “is an economic policy and advocacy organization whose members are the eight largest and most diversified financial institutions headquartered in the United States.” Therefore, and not surprisingly, this is just another bank lobby group funded by the largest U.S. banks.

In addition, there were very concerning comments from Michael Hsu, who is the Head of Comptroller of the Currency, one of the largest U.S. banking regulators. The remarks made by Mr. Hsu basically suggest that there is potential that the implementation of Basel 3 endgame rules could be completely abandoned in the U.S.

“Failure to finalise stricter stability rules could lead to an “unravelling internationally” of guardrails put in place after the financial crisis and create conditions for a new global banking meltdown, a top US regulator has warned. Michael Hsu, the acting Comptroller of the Currency, told the Financial Times such a breakdown “would create unhelpful uncertainty for US banks, could lead to a race to the bottom, which would sow the seeds for a future financial crisis and it would hurt US credibility and leadership on these issues.”

Finally, David Solomon, who is the Chairman and CEO of Goldman Sachs (GS), made the following comment during the bank’s Q3 conference call.

I want to spend a moment on capital and Basel III revision. Although, we have closely followed the recent remarks from regulatory officials about the upcoming reproposal, we continue to have concerns about the overall regulatory process. There remains a lack of transparency and appreciation for the interconnectedness of capital requirements across the proposed fundamental review of the trading book, CCAR and the G-SIB buffer. We recognize this is an ongoing process that will take time, but as we've said before, we need to get this right.

All of the above suggests to us that banking lobbyists are likely preparing another fierce campaign against the Basel 3 endgame rules, which will likely further water down protections for the public depositors.

Bottom Line

We believe this is another reminder that you should not rely on the banking regulators to protect your bank deposits because, as we see, they apparently are under significant pressure from the very powerful banking lobby.

Believe it or not, there are major issues on these larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank (NYCB) is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology outlined here.