Another GFC Warning Signal For Major U.S. Banks

Our latest article on bank safety: Another GFC Warning Signal For Major U.S. Banks

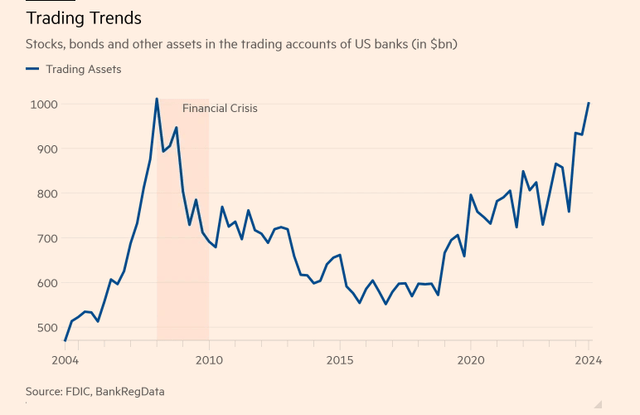

Trading assets of U.S. banks have recently surpassed $1 trillion for the first time since the Great Recession.

Financial Times

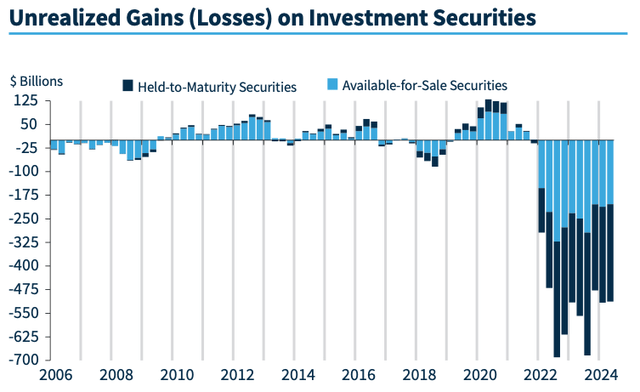

First and foremost, trading assets are not part of AFS (available-for-sale) and HTM (held-to-maturity) securities. If you follow our banking work, you know that we have discussed unrealized losses of U.S. banks from AFS and HTM securities a lot. According to the FDIC, these losses are now more than $500B.

FDIC

But trading assets are a separate item on an US bank’s balance sheet. While AFS and HTM securities include predominantly Treasuries, residential mortgage-backed securities, and commercial mortgage-backed securities, trading assets consist of mostly equities and high-risk structured credit products.

Unsurprisingly, almost all of the sector’s trading assets are being held on the balance sheets of the largest banks. Out of $1 trillion of the sector’s trading assets, $937B are owned by JPMorgan (JPM), Bank of America (BAC), Citi (C), Goldman Sachs, and Morgan Stanley (MS).

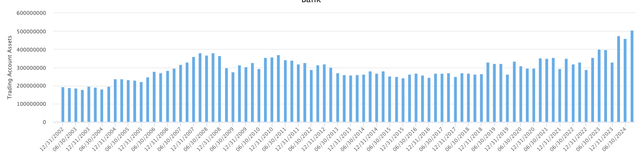

JPMorgan (JPM) has more than $500B of trading assets on its balance sheet, which is more than half of the sector’s total trading assets.

JPM: Trading assets

FFIEC

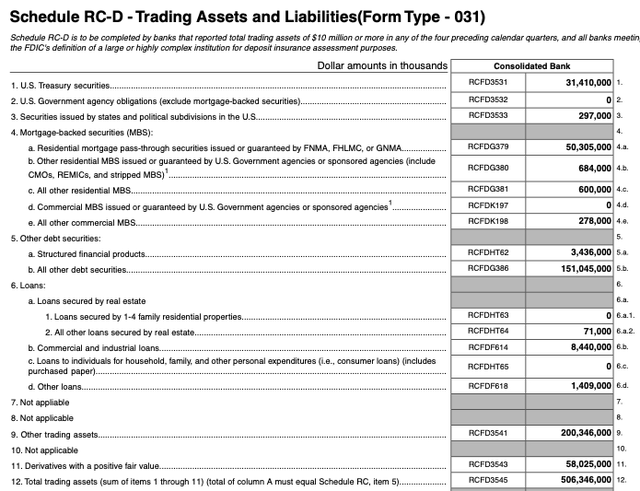

Below is a breakdown of JPM’s trading assets. As you can see, the bank has more than $150B of “all other debt securities,” which are highly likely to be risky structured products. There are also more than $200B of “other trading assets,” which are equities. In addition, there are $58B of derivatives.

FFIEC

As of the end of the third quarter, JPM’s trading assets were 14% of the bank’s total assets. More importantly, the bank’s trading assets are significantly higher than its equity. As of the end of 3Q, JPM’s trading assets were $506B, while its total equity was $318B.

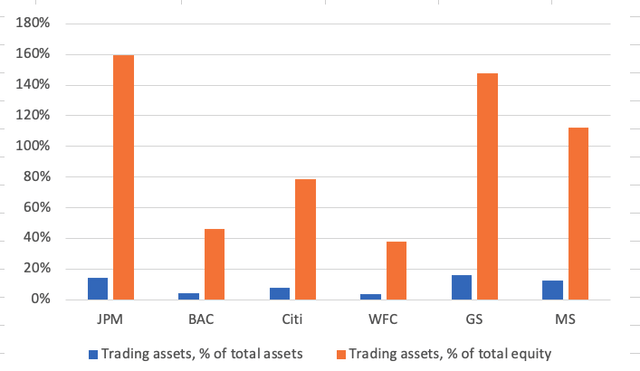

Below we also show trading assets of the Big Six as percentages of total assets and equity. As you can see, trading assets correspond to very large shares of the largest U.S. banks’ capital position.

FFIEC

As such, this is another issue that can eat up a huge part of U.S. banks’ capital positions or even make them go underwater, especially if the market begins to transition into the long-term bear market we are expecting.

Bottom line

Believe it or not, there are more major issues on the larger bank balance sheets as compared to smaller banks, which we have covered in past articles. Moreover, consider that there was one major issue which caused the GFC back in 2008, whereas today, we currently have many more large issues on bank balance sheets. These risk factors include major issues in commercial real estate, rising risks in consumer debt (approaching 2007 levels), underwater long-term securities, over-the-counter derivatives, and high-risk shadow banking (the lending for which has exploded). So, in our opinion, the current banking environment presents even greater risks than what we have seen during the 2008 GFC.

Almost all the banks that we have recommended to our clients are community banks, which do not have any of the issues we have been outlining over the last several years. Of course, we're not saying that all community banks are good. There are a lot of small community banks that are much weaker than larger banks. That’s why it's absolutely imperative to engage in a thorough due diligence to find a safer bank for your hard-earned money. And what we have found is that there are still some very solid and safe community banks with conservative business models.

So, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, and you can read about them in the prior articles we have written.

Moreover, if you believe that the banking issues have been addressed, I think that New York Community Bank is reminding us that we have likely only seen the tip of the iceberg. We were also able to identify the exact reasons in a public article which caused SVB to fail. And I can assure you that they have not been resolved. It's now only a matter of time before the rest of the market begins to take notice. By then, it will likely be too late for many bank deposit holders.

At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you're relying on the FDIC, I suggest you read our prior articles, which outline why such reliance will not be as prudent as you may believe in the coming years, with one of the main reasons being the banking industry’s desired move towards bail-ins. (And, if you do not know what a bail-in is, I suggest you read our prior articles.)

It's time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Our due diligence methodology is outlined here.